The duty hike — estimated to bring an additional Rs 4,830 crore to the exchequer — however, was criticised by jewellers, who said the move might lead to a rise in gold smuggling and raise the yellow metal’s price by Rs 600 per 10 grammes.

“As part of measures to contain CAD, Customs duty on gold and platinum has been increased from eight per cent to 10 per cent and that on silver from six per cent to 10 per cent,” the finance ministry said in a notification presented in Parliament on Tuesday.

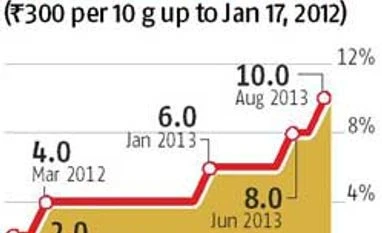

Since January 2012, when import duty on gold was raised from Rs 300 per 10 g to two per cent and that on silver from Rs 1,500 per kg to six per cent, this is the fifth duty rate increase for gold and first for silver.

The move came a day after Finance Minister P Chidambaram told Parliament the government would restrict CAD at $70 billion in 2013-14, compared with $88.2 billion the previous year, by curbing imports of gold, silver, oil and non-essential goods.

Gems & Jewellery Trade Federation Chairman Haresh Soni said: “The major objective of duty increase is to control CAD, which, somehow, has not been resolved with similar steps in the past. The sixth import duty increase in less than 20 months will only increase import through illegal channels.”

Dore bars are semi-pure alloy of gold and silver mined from ore. Such bars, when imported into the country, are refined for further purification. Excise duty on refined gold bars has also been increased from seven per cent to nine per cent. Likewise, on silver manufactured from ore, it has been increased from four per cent to eight per cent.

As Cenvat credit was allowed on refined bars, the excise duty rates had been increased to maintain the margin of one percentage point, Revenue Secretary Sumit Bose explained.

Asked about the proposed increase in import duties on non-essential goods, he said the government was still working on that. Shortly after the hike was notified, bullion traders said the price of gold would go up by Rs 600 per 10 g. Continuing its rising streak for a fifth straight day, standard gold prices on Tuesday rallied Rs 565 per 10 g in Delhi to a four-month high of Rs 29,825.

India is a major importer and consumer of gold and silver. The country had in 2012-13 imported 845 tonnes of the yellow metal, valued at Rs 2.46 lakh crore. Its import of silver in the year had stood at 1,963 tonnes, worth Rs 10,691 crore.

ALSO READ: Jewellers attract customers through offers

In April-July this year, gold imports rose 87 per cent to 383 tonnes, from 205 tonnes in the same period last year. In value terms, the imports went up from Rs 56,488 crore to Rs 95,092 crore — an increase of about 68 per cent. Silver imports in the four-month period increased 200 per cent — to Rs 12,789 crore from Rs 4,281 crore in the year-ago period.

Mainly due to a spike in imports of gold, silver and crude oil, the country’s CAD had swelled to 4.8 per cent of GDP last year. With several duty increases by the government since January last year, smuggling of the yellow metal has seen a jump. As many as 220 cases (Rs 59.82 crore) of gold seizure were detected in the April-June period this year, against 204 cases (Rs 12.86 crore) in 2012-13 and 64 cases (Rs 9.82 crore) in 2011-12.

ALSO READ: Worse than the disease

Jayant Manglik, president (retail distribution), Religare Securities Ltd, said: “The fear is that the government’s move might make gold smuggling attractive again. Silver duty, too, has risen but the absolute numbers are relatively small.”

The government also recognised this fear. In a written reply in the Rajya Sabha, Minister of State for Finance J D Seelam said there had been apprehension that a duty hike might lead to an increase in gold smuggling. He said Customs and other formulations had been alerted to keep a vigil. During April-July this year, 294 kg of gold, valued at Rs 75 crore, had been seized by revenue authorities.

)