Despite multiple trade talks with Washington DC breaking down, India may again delay the imposition of higher duties on 29 key imports from the US set to go live from August 4.

Senior sources suggested that the commerce department has requested the revenue department under the finance ministry to revert to its earlier order and extend the date for imposing higher import duties by 45 days. A final decision will be taken by the Central Board of Indirect Taxes and Customs, which is legally bound to bring out an official order on the issue by Friday, they added.

Despite announcing a steep tariff hike on US imports last month, India had hoped for a breakthrough in talks before August 4, when the tariffs were supposed to go live. “After these talks stretched on till the early part of this week, final negotiations between both sides had broken down as Washington DC was not interested in providing exemption to India from its tariffs on steel and aluminium, as we had wanted,” a senior commerce ministry official said.

The August 4 deadline in itself was a delayed one announced on June 28, which is when the tariffs were initially expected to be imposed.

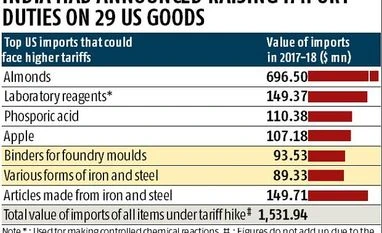

Higher tax by up to 50 per cent on agri goods like apples, almonds, walnuts along with industrial products and steel had earlier been announced by India, aimed at raking in an estimated $240 million worth of additional taxes.

Spread across sectors from which imports stood at $1.5 billion in 2017-18, New Delhi claimed the amount was equal to the estimated loss faced by India after the Trump Administration hiked import duties on steel and aluminium in May.

Trade experts have pointed out the need for India to remain cautious while responding to the US. “This increase will be in addition to raising new trade barriers, make domestic manufacturing more attractive as the steep increases in Customs duties may make imports unaffordable. For agri products such as pulses, which have witnessed an increase from 30 per cent to 70 per cent, this would provide encouragement in increasing the cultivable area, on the back of good pulses production in recent years,” M S Mani, indirect tax partner, Deloitte India, said.

More From This Section

Among the commodities to be hit by the list of items targeted by India, apples and walnuts remain crucial with farms stateside being the largest source for India. Overall fruit import from the US remained $872 million in 2017-18, with India being one of the largest markets.

US aims for market access

At the same time, to offset the hit to these mostly agricultural products, the US is eyeing market access for soybean meal and easier norms on its cherries, as it battles the fallout of multiple tariff escalation. “We are looking for market access for American cherries, avocados, and soybean meal feed for livestock,” Mark Wallace, acting minister counsellor at the US Department of Agriculture, told Business Standard last week. Negotiations on these are on, he hinted.

The global trading mechanism has been shaken up by $34-billion worth of tariff hikes announced by both the US and China last weekend. Since then, Trump has threatened an additional $200 billion worth of tariffs on Chinese goods and Beijing has indicated it won’t cow down.

On the other hand, Washington DC recently granted India the Strategic Trade Authorisation (STA-1) status. This is expected to give a major fillip to the defence partnership between both nations. The status places India on the same level as NATO allies which would allow New Delhi access to high-grade military technology that had hitherto been refused to it.

)