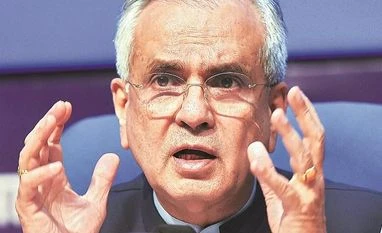

India is seeing an increasing digitization of financial services, with consumers shifting from cash to cards, wallets, apps, and UPI, Niti Aayog Vice-Chairman Rajiv Kumar said on Monday.

While releasing a report -- Connected Commerce: Creating a Roadmap for a Digitally Inclusive Bharat -- prepared jointly by Niti Aayog and Mastercard , Kumar said this report looks at some key sectors and areas that need digital disruptions to bring financial services to everyone.

"Technology has been transformational, providing greater and easier access to financial services. India is seeing an increasing digitization of financial services, with consumers shifting from cash to cards, wallets, apps, and UPI," he said.

The report recommended that there is a need to strengthen the payment infrastructure to promote a level-playing field for NBFCs and banks.

It also pitched for digitizing registration and compliance processes and diversifying credit sources to enable growth opportunities for MSMEs.

According to the report, there is a need to

build information sharing systems, including a 'fraud repository', and ensuring that online digital commerce platforms carry warnings to alert consumers to the risk of frauds.

Also Read

It also pitched for enabling agricultural NBFCs to access low-cost capital and deploy a 'phygital' (physical + digital) model for achieving better long-term digital outcomes.

"Digitizing land records will also provide a major boost to the sector," the report said, adding that to make city transit seamlessly accessible to all with minimal crowding and queues, there is need to leverage existing smartphones and contactless cards, and aim for an inclusive, interoperable, and fully open system.

Also speaking at the event, Mastercard. Asia Pacific Co-President Ari Sarker said the Covid-19 pandemic has alerted us all to the fragility of cash and the resilience of digital technologies, including digital payments.

"India has changed its operating landscape in making digital more accessible and friction free. It is one of the most advanced digital payments environment in the world. Now is the time to take our learnings and digital transformation-at-scale with speed and agility," he said.

Niti Aayog CEO Amitabh Kant said in the post-COVID-19 era, building resilient systems and encouraging business models that could be change-makers of the future are crucial.

Kant further said India is emerging as the hub of digital financial services globally, with solutions like UPI growing tremendously and being hailed as instrumental in bringing affordable digital payment solutions to the last mile.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)