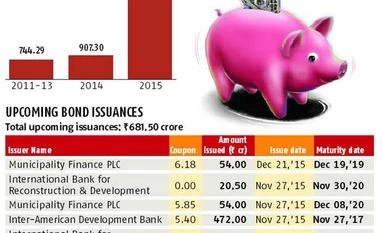

Each issuance size is small, as investors are still testing the waters. Even so, Rs 4,132 crore worth of rupee bonds so far this year have been issued to Japanese investors and another Rs 681 crore is lined up till December. In 2014, Rs 907 crore of such bonds were issued and Rs 744 crore was raised between 2011 and 2013.

These 'uridashi bonds' are papers issued to Japan's retail investors, commonly known by the moniker of 'Mrs Watanabe' as the matron responsible for maximising returns on her family's earnings.

Long years of low interest rates in Japan forced retail investors there to bet on currencies worldwide from the 1990s and are now considered a significant force in the world currency market.

As speculators and carry traders, the Watanabes invest in markets where currencies are stable but offer relatively higher yields.

"The interest in retail bonds with the Indian rupee being the base currency is picking up. The interest rate is higher than that in the euro, dollar or other currencies, and there is a functioning swap market behind. The choice of currency is by the distributors in Japan," said Martin Svedholm, manager, funding, for Municipality Finance Plc, a major financial institution in Finland.

MuniFin regularly taps into the 'uridashi' market and is one of the top issuers of rupee bonds. In 2014, it issued bonds worth Rs 300 crore and in 2015, its target is Rs 417 crore, including Rs 54 crore each on November 27 and on December 21.

The coupon payable will be 5.85 per cent for bonds maturing on December 8, 2020, and 6.18 per cent for bonds maturing on December 19, 2019, respectively.

Except for a sporadic spike, the rupee has been trading in a narrow band since 2014, though the band shifts every year as the currency goes through a gradual depreciation in response to its export competitors lowering their exchange rate.

Financial institutions raising money from the Japanese markets are advised by local distributors to issue rupee bonds, revealed the issuers of such bonds. Business Standard tried to contact two large distributors in that country, Tokai Tokyo Securities and Musashi Securities, but could not get past the language barrier.

Issuers range from all corners of the world - from multilateral agencies like various arms of the World Bank, Scandinavia's financial institutions like MuniFin and Nordic Investment Bank, and other banks like BNP Paribas, Credit Agricole, Deutsche Bank.

Barclays Bank, HSBC and Royal Bank of Scotland have all issued rupee bonds to the Watanabes.

Data with Bloomberg show the first rupee bond was issued by Norway's Kommunalbanken, when it raised Rs 13.8 crore at a five per cent coupon in 2011. These bonds will mature in June 2016.

To internationalise the rupee, International Finance Corporation (IFC) had issued $1 billion of offshore rupee bonds maturing in 10 years, target to institutions in November 2013.

However, it is the World Bank's retail bond issuance that really gave a push to such rupee-denominated issuance.

The Bank issued a five-year bond at a 4.2 per cent coupon in January this year. Most of these bonds' proceeds do not end in India directly, and the rupee is only the underlying currency.

While the Watanabes get interest rates higher than those available elsewhere globally, the institutions raising these funds get their money at close to a zero interest rate as they swap the rupee loan with the euro or dollar.

When one moves from a higher interest rate-bearing currency (rupee) to a lower one (euro or dollar), the party with the rupee gets a forward premium.

The cross-currency swap rate for rupee-euro is 6.35 per cent at present. This forward premium, received every year, takes care of the coupon rate on the bonds.

"We do not take currency risks and swap our exposures to the euro with a third party (an international bank)," said Svedholm on telephone.

At the time of maturity, the borrowing financial entity swaps the euro or dollar back to the rupee at a pre-determined price, and repays the rupees to Mrs Watanabe.

If the rupee depreciates less than her coupon or remains stable, she earns a positive return on her investment. If the depreciation is more than her coupon rate, she loses. Consequently, if the rupee appreciates, the appreciation adds to her coupon rate, as she gets more yen for her invested rupee.

The rupee bonds' spurt in 2015 happened after the World Bank issued such a bond in Japan.

Such issuances could turn into a deluge globally, as RBI has allowed Indian companies to raise rupee loans directly from the foreign market, say bankers involved in such bond issuances.

The rupee swap market is deep internationally. "Up to 10-year rupee swaps are readily available as banks, importers and investors from India are sitting there to swap all global currencies for the rupee.

The demand for the rupee is quite robust in these markets," said Samir Lodha, head of Quantart Markets Solutions, a corporate treasury consultant.

"Typically, the banks swapping euro for rupee have clients for rupee loans or are invested in various sectors, like renewable energy, in India," said Pramit Brahmbhatt, head of Veracity Group, a brokerage. He is a former head of retail-focused global currency broker Alpari Group's Indian arm.

Adding: "Japanese retail investors are a big force and their focus has shifted to the rupee as it gets more internationalised, after RBI allowed Indian companies to raise rupee loans directly from overseas institutions."

)