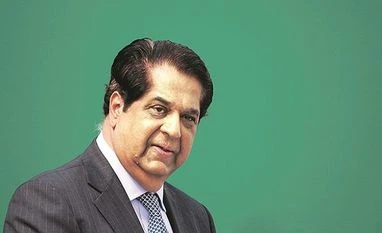

The KV Kamath Committee’s report has outlined financial ratios for the 26 sectors impacted the most due to the outbreak of Covid-19 pandemic. The benchmarks, analysts say, seem reasonable with debt being split into mild, moderate, and severe.

“The five key ratios -- Debt/equity, Debt/EBITDA, Current Ratio, Debt Service Coverage (DSCR), and Average Debt Service Coverage (ADSCR) -- have been set reasonably, so most companies facing stress should be able to see restructuring. That apart, the committee has also asked banks to split restructured loans into mild, moderate, and severe stress which, we believe, will also be useful to investors to assess the nature of restructuring,” said a Jefferies’ note.

According to the panel’s guidelines, the sector specific parameters may be considered as guidance for preparation of resolution plan (RP) for a borrower in the specified sector. The RP may be prepared based on the pre-Covid-19 operating and financial performance of the borrower, impact of Covid-19 on its operating and financial performance in Q1 and Q2FY21, to assess the cash-flows for FY21 / FY22 and subsequent years.

In respect of those sectors where the threshold parameters have not been specified, the Kamath-headed panel noted that lenders can make their own internal assessments for the solvency ratios i.e. TOL/Adj TNW (Total Outside Liability/ Adjusted Tangible Net Worth) and Total Debt/EBIDTA. “However, the current ratio and DSCR shall be 1.0 and above, and ADSCR shall be 1.2 and above,” it said.

“Since most of the ratios are to be considered from pre-Covid times, corporate firms which faced issues post lockdown will be able to take the benefit,” says Siddharth Purohit, equity analyst at SMC Securities.

According to the committee report, 72 per cent of banking sector debt has been impacted from Covid-19. Of this, around 70 per cent is impacted by Covid-19; while 45 per cent was stressed even pre-Covid-19, and only 30 per cent (Rs 15.5 trillion) is purely impacted by Covid-19.

The committee further highlighted that around Rs 38 trillion of banking sector debt has been in key sectors affected by Covid-19, thus forming 37 per cent of the total banking system credit. “Furthermore, the top 10 affected sectors account for approximately 29 per cent of the total banking credit. Among the banks, total exposure toward the key troubled sectors forms 15–31 per cent of total fund-based exposure, with the highest being for SBI (31 per cent) and the lowest for ICICI Bank (15 per cent),” said a September 8 note by Motilal Oswal Financial Services.

That said, the committee fell short of highlighting its own assessment with respect to the quantum of loans that could be restructured, analysts say.

“Determining the levels of restructuring will be an arduous task. Although, looking at the laid out sector specific thresholds on the ratios, we room for lenient restructuring will not be possible on tightly knit framework. Action on asset quality will be only visible in FY22 and looking at the impact over sectors as outlined in the report, we believe banks will continue to make higher provisions,” said a report by Prabhudas Lilladher.

Limitations

Analysts remain skeptical of the timeline to implement the restructuring guidelines and the number of companies that may meet the eligibility criteria. Those at Jefferies, for instance, say that restructuring will have to start once the Supreme Court closes the moratorium/interest waiver case. The next hearing on the subject matter is scheduled for September 10.

ALSO READ: Kamath committee suggestions are a good start for resolving a big problem Yuvraj Choudhary and Mohit Mangal, research analysts at Anand Rathi caution that most of the identified sectors which were stressed by Covid-19-related disruptions and opted for the moratorium, were already looking at an uphill task of resuming loan repayments, including arrears from the moratorium period. That apart, an analysis of loans restructured between FY15 and FY19 done by them highlights that most of the restructured accounts eventually turned non-performing.

“With the ability to generate healthy cash-flows for a few industries impaired by the Covid-19-related disruptions, we believe restructuring would only provide short-term relief to the banks. Given the impaired ability to generate healthy cash flow, some of these disruptions may continue for a few more months. We believe a good portion of these restructured accounts may eventually turn non-performing,” they said.

Additionally, global brokerage Nomura’s assessment suggests that 30-50 per cent of the companies across most sectors do not meet the necessary criteria on backward-looking data.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)