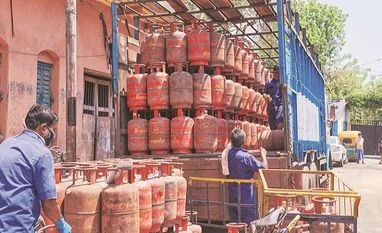

With negligible subsidy being borne by the government on domestic Liquefied Petroleum Gas (LPG) cylinders, private players are looking to expand their domestic LPG business. This opens the doors further for companies, like Reliance Gas, GoGas and Puregas, that are already in the business.

These private players were focussing more on commercial LPG since cooking gas subsidy was never available to them but only the government-owned oil marketing companies (OMCs). But with global LPG prices tempering, and the government quietly phasing out cooking gas subsidy in May 2020, the opportunity for private players in the domestic market has grown. Despite prices rising to record highs, the subsidy on LPG has not been reinstated by the government.

A domestic LPG cylinder of 14.2 kilogramme now costs Rs 884.50 in the national capital. While the earlier governments attempted to keep LPG prices at largely below Rs 500 a cylinder, the current government has allowed market forces to take charge.

This could now help companies like Reliance Gas, a part of Mukesh Ambani owned Reliance Industries (RIL), to get into domestic LPG business aggressively since it could price LPG competitively. Reliance Gas offers domestic connections in Maharashtra, Madhya Pradesh, Gujarat, and Rajasthan. These regions are largely serviceable from RIL’s refinery in Jamnagar.

In Ahmedabad, a domestic 15 kg cylinder of Reliance Gas costs Rs 1,200. This translates to Rs 80 a kg. Dealers of Puregas, part of Aegis Logistics, sells a 15 kg domestic LPG cylinder for roughly Rs 1,300 which equals Rs 87 a kg. For GoGas, a unit of Confidence Petroleum, one 15 kg domestic LPG cylinder retails at Rs 1,200 which comes to Rs 80 a kg.

Comparably, a domestic LPG cylinder sold by OMCs is around Rs 891.50 a 14.2 kg cylinder, or Rs 63 a kg of LPG.

These private companies say they offer faster service, and fresh connections within 48 hours. Most dealers of private companies offer cylinders immediately with minimal paper work to woo consumers new to a city. Comparably, getting an LPG connection from a PSU can take days, if not weeks in some cases.

“There is much higher scrutiny while giving out PSU domestic LPG connections to minimise pilferage of subsidy. While the subsidy regime has largely been phased out, the scrutiny still remains,” an LPG dealer who has an Indane Gas agency (part of IndianOil) told Business Standard. OMCs also try to prevent diversion of cylinder meant for domestic cooking for commercial purpose. Domestic gas attract 5 per cent goods and service tax while commercial LPG is expensive because it attracts 18 per cent rate.

Despite the market linked pricing, PSUs also go the extra mile to keep domestic LPG costs a tad bit lower than commercial LPG. “There are some additional costs that we recover from commercial cylinders. This keeps domestic LPG cylinders from PSUs cheaper despite the lowered subsidy,” an IndianOil official said.

The private players are also banking on relaxations given in the Parallel Marketing System (PMS) of LPG as allowed by the Ministry of Petroleum and Natural Gas. According to CRISIL, the scope for parallel marketers in India includes importing, storing, transporting, bottling, marketing, distribution and sale – or any activity relating to the LPG business.

Since LPG is a scarce commodity in the country, its export or free market retailing is not allowed under a business-as-usual scenario. The Oil Ministry’s January 2014 order reiterates that sale of indigenously produced LPG is permitted only to PSU oil companies, namely IndianOil, Hindustan Petroleum, and Bharat Petroleum. In 2015, this order was relaxed and the centre allowed RIL to sell up to 10,000 tonnes per month of LPG from its refineries to private cooking gas marketers. This was subject to RIL ensuring that it supplies an equal quantity of LPG to PSU refineries at cost neutral or cheaper rates.

This helped RIL gain more from the PMS scheme as private players, interested in LPG marketing or RIL itself, would be able to buy LPG directly from RIL refineries.

But this was not enough to meet all requirement. According to an official from one of the private companies, their cylinders also cost more because they are selling imported LPG, that is subject to a 5 per cent customs duty. “The LPG sold by PSUs is made from crude oil that has no import duty. The private players without refineries, basically everyone except Reliance, has to either buy finished products from domestic refiners, or import them from the international market. This pushes up input costs for private companies, resulting in more expensive domestic cylinders,” he said.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)