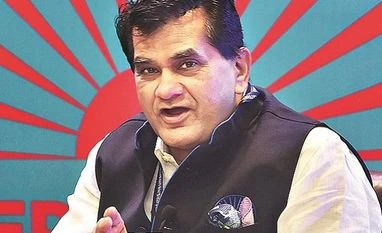

NITI Aayog Chief Executive Officer Amitabh Kant (pictured) is likely to meet the heads of all two- and three-wheeler companies in New Delhi on June 21 to discuss the road map for the adoption of electric vehicles (EVs).

The move comes in the wake of criticism from top auto companies and industry bodies such as the Confederation of Indian Industry (CII) and the Society of Indian Automobile Manufacturers (Siam) that the government is rushing into the adoption of EVs without thinking the policy through.

Those expected to attend the high-level, closed-door meeting include Pawan Munjal, chairman, Hero MotoCorp; Rajiv Bajaj, managing director, Bajaj Auto; Venu Srinivisan, chairman, TVS Motor; and Pawan Goenka, managing director, Mahindra & Mahindra.

All of them have voiced their disapproval of the government’s proposal that three-wheelers and two-wheelers below 150cc would need to transition to EVs by 2023 and 2025, respectively.

India is the world’s largest market for two- and three-wheelers. It sold 21,181,390 units of two-wheelers and 701,011 units of three-wheelers in 2018-19.

Most automakers agree in principle with the government’s push for the use of clean technologies and are willing to make investments to realise that goal. However, they insist on a gradual,

phase-wise implementation of the plan in order to ensure that the transition is seamless and does not cause undue disruption in the auto industry.

In a statement last week, Rajan Wadhera, president, Siam, said, “The plan needs to be put in place with a practical approach and without needlessly disrupting the automotive industry.”

Stakeholders worry that a hasty transition to EVs in the two- and three-wheeler segments would throw the auto component industry into disarray. The $55-billion industry, which relies heavily on the production of powertrain-related parts (close to 60 per cent), is dominated by small and medium enterprises, and provides employment to more than 3 million people.

Ram Venkataramani, president, Automotive Component Manufacturers Association of India, pointed out that the industry was already under tremendous pressure. On the one hand, it was beleaguered by a slump in auto sales, and on the other, it had the daunting task of meeting the stringent deadlines for switching from Bharat Stage (BS)-IV to BS-VI emission control norms and complying with a host of other safety norms.

Pushing for EVs at such a juncture “could be highly disruptive for the auto component industry. It also puts a question mark on the fate of the Rs 50,000-crore investment being made by the automobile ecosystem for BS-VI,” said Venkataramani. Hence, the government ought to engage with the stakeholders before taking any major decisions in this regard, he added.

On Saturday, Minister for Road Transport and Highways, Nitin Gadkari, too, called for wider stakeholder consultation on the adoption of EVs. Talking to journalists on the sidelines of a CII event in Delhi, Gadkari said the government would give adequate time to manufacturers to make the necessary business adjustments.

In February this year, the Narendra Modi-led National Democratic Alliance government approved a scheme to spend Rs 10,000 crore to subsidise the sales of electric and hybrid vehicles in an effort to curb pollution and reduce the dependency on fossil fuels. The scheme, known as Faster Adoption and Manufacturing of (hybrid) and Electric vehicles (FAME), offers subsidies based on the battery capacity of the EVs — whether they are buses, cars, three-wheelers or motorcycles.

“Although the targets are aggressive, if done systematically, the volume potential for EVs, through the electrification of two- and three-wheelers, can be really high,” said Kaushik Madhavan, vice-president-mobility, at consulting firm Frost & Sullivan.

Moreover, it could spur the local production of aggregates and parts, including lithium ion batteries, and thereby drive down costs, said Madhavan. In the absence of enough volumes, lithium ion batteries, which account for close to 70 per cent of the cost of an EV, are currently imported.

The move would also pave the way for other segments of the automobile industry to adopt EVs, added Madhavan.

Reverse gear?

- Move comes in the wake of criticism that the Centre is rushing into the adoption of EVs without thinking the policy through

- India is the world’s largest market for two- and three-wheelers

- It sold 21,181,390 units of two-wheelers and 701,011 units of three-wheelers in 2018-19

- Most automakers agree in principle with the Centre’s push for the use of clean technologies and are willing to make investments to realise that goal

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)