Credit costs — the amount set aside for bad loans and stressed assets — for ageing non-performing assets (NPAs) and National Company Law Tribunal cases would take provision coverage ratio to 58-60 per cent by the end of FY18, from 44.3 per cent at the end of March 2017, according to rating agency ICRA.

Banks’ credit provisions surged to Rs 64,500 crore during Q2 FY18, up 40 per cent on a sequential basis and 30 per cent on a year-on-year basis. For April-September FY18, the total credit provisions were up 17 per cent on a year-on-year basis at Rs 1.1 lakh crore.

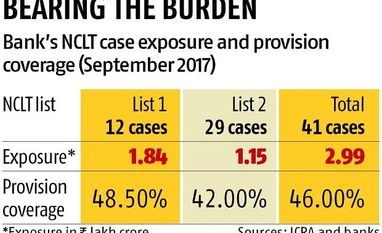

“The total exposure of Rs 3 lakh crore of accounts is likely to be resolved under the Insolvency and Bankruptcy Code (IBC). And the overall credit provisions are likely to be at Rs 2.4-2.6 lakh crore (including impact of ageing on existing NPAs and provisioning on IBC accounts) for FY18, against Rs 2 lakh crore during FY17,” ICRA said. Out of this, requirement provisions of NCLT cases on lists 1 and 2 (see chart) are Rs 45,000-60,000 crore in the second half of the current financial year. Most of the burden would fall on public sector banks (PSBs). This can result in losses before taxes of Rs 30,000-40,000 crore for PSBs during FY18.

Fresh slippages during Q2 FY18 stood at 3.9 per cent (annualised), the lowest since the beginning of the asset quality review initiated by the Reserve Bank of India during Q3 FY16. More than 80 per cent of the slippages during the quarter were outside the standard restructured advances. The slippages ratio was 6.3 per cent (annualised) during Q1 FY18 and 5.5 per cent for FY17. ICRA said the asset quality pain was likely to continue in the near term with Rs 1.7 lakh crore of standard restructured advances.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)