The government and the Reserve Bank of India (RBI) seemed to have ironed out their differences for now, as both camps showed flexibility on a number of issues that were considered to be flashpoints between the two.

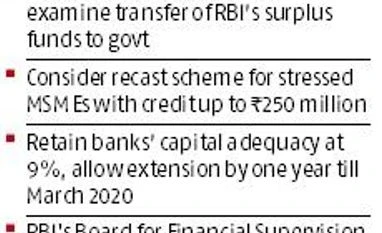

The board decided to set up a panel for transfer of the RBI’s surplus funds to Centre, review the prompt corrective action (PCA) framework, frame a restructuring scheme for stressed micro-, small- and medium enterprises (MSMEs) loans and relax a component of capital adequacy norms by one year.

In a nine-hour meeting at the RBI headquarters, the central bank's board decided to constitute an expert committee to examine the economic capital framework (ECF) of the central bank. The membership and terms of reference of this committee would be jointly decided by the government and the RBI.

Sources said the committee would not delve into the treatment of its past reserves. “The committee will look into the future reserves of the RBI and how much surplus it may transfer to the Centre,” an RBI board member said, requesting anonymity. “There was a big discussion on the past reserves of the RBI. The board was not in agreement at touching the RBI’s past reserves. It was in agreement that it is a technical subject and a committee should look into it,” the person added.

The total reserves with the RBI stood at Rs 9.6 trillion at the end of its financial year ended June 2018, up from Rs 8.38 trillion in the previous year, while its foreign assets were at Rs 26.4 trillion in FY18, up from Rs 23.7 trillion a year ago.

The next board meeting is scheduled to be held on December 14 that will discuss the agenda items related to liquidity in non-banking financial companies (NBFCs) and ‘governance in the RBI’, sources said.

The RBI extended the transition period for maintaining a capital conservation buffer (CCB) of 0.625 per cent by one year till March 2020, while maintaining capital adequacy at 9 per cent. The extension is expected to free up capital in excess of Rs 300 billion, giving banks more room for lending, said a senior banker.

At the board meeting, RBI Governor Urjit Patel was of the firm view that the PCA regulation aimed at strengthening the financial position of banks should not be tinkered with as it would set a bad precedent, sources present in the meeting said.

On the prompt corrective action (PCA) framework, RBI’s Board for Financial Supervision (BFS) will have its final say, RBI said in a statement. The BFS is expected to discuss the PCA issue in its December 6 meeting. It will consider whether some banks can be moved out of PCA based on their financial performance and whether some of the parameters within the PCA may be eased, as per the government's suggestions.

The RBI, however, clarified that banks may be brought out of the PCA framework, as per present rules, after registering an annual profit. The government had interpreted the RBI's April 2017 revised framework in a way that banks need to register at least two years of profit to come out of PCA, sources said. The government had requested the RBI to bring some banks out of PCA based on their improved provisioning of bad loans and better financial conditions.

Of the 11 public sector banks (PSBs) under PCA, around three-four banks could come out of the restricted lending framework, sources said.

“The board also advised that the RBI should consider a scheme for the restructuring of stressed standard assets of MSME (micro, small and medium enterprises) borrowers with aggregate credit facilities of up to 250 million, subject to such conditions as are necessary for ensuring financial stability,” RBI’s statement said.

The deputy governors of the RBI made separate presentations on the government’s demand for providing liquidity to non-banking finance companies and MSMEs, prompt corrective action norms and the economic capital framework, sources said.

The RBI was not convinced about a special refinance window for NBFCs, as it has been maintaining it in the past. “Multiple data points were discussed but nothing was conclusive. So there will be further discussions on this in the next board meet,” the source added.

In another statement on Monday, the central bank announced that it will conduct open market operations (OMO) aggregating Rs 80 billion on November 22, "based on an assessment of prevailing liquids conditions and also of the durable liquidity needs going forward.”

Sources said the RBI board meeting was cordial compared to the last meeting held on October 23 and termed it “constructive.” “Everyone wanted to find a solution instead of public bickering,” the person said. Another source concurred: “There were no heated exchanges between government nominees and RBI officials. The acrimony has been left behind.”

Former Finance Minister P Chidambaram said he was glad that the government has stepped back and grudgingly acknowledged the independence of the RBI. “My guess is that the independent directors (at least most of them) realised that the government was on a perilous course and refused to go beyond giving advice to the RBI,” he added.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)