The Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6 per cent. The six-member Monetary Policy Committee (MPC), headed by Reserve Bank of India (RBI) Governor Urjit Patel, announced interest rate decision on Wednesday while presenting its fourth bi-annual monetary policy.

Analysts largely expected the central bank to maintain the status quo, but added there could be a rate cut later in the financial year.

Next policy meeting has been scheduled for December 5.

Here's what experts have to say: Tushar Arora, Senior Economist of HDFC Bank to Sify.com

"No surprises as such. Going strictly by the optics of headline inflation is unlikely to result in rate cuts. Room to maneuver will only come if the MPC chooses to utilize the +/-2 percent bandwidth and indeed looks through a marginal rise in inflation above the 4 percent level. I believe this could happen later during the year as growth numbers continue to surprise on the downside."

Upasna Bhardwaj, Senior economist at Kotak Mahindra Bank

"I don't see much of a surprise. RBI has highlighted risks from inflation which were known. Going ahead the room for further action looks very limited. But we do not completely rule out a possible rate cut in upcoming policy, considering factors like growth which isn't particularly robust as of now.

"We believe that RBI will stay on status quo for the rest of the year. RBI and government don't have different objectives, although their means could be different. I don't see any increased tensions between them."

Sunil Sinha, director at India Ratings

"In my view, another rate cut this fiscal is unlikely unless retail inflation surprises on the downside and inflation levels turn out to be lower than the central bank's expectations."

Varun Khandelwal, Managing director of Bullero Capital

"Chances of a rate cut in the next few months are extremely low. Without getting into value judgments on the sensibility of the MPC's actions, it is quite clear from their refusal to cut rates despite a dramatic fall in inflation that they really do not want to cut. The impending tightening of monetary policy globally, easing in fiscal discipline, rise in commodity prices are all factors which will reinforce its hawkish stance further."

Here is what the panel said:

Urjit Patel:Teething problems related to GST might soon be resolved

Urjit Patel: Household consumption demand may get upward boost from housing allowance

Urjit Patel: States' farm loan waivers may result in fiscal slippages

Urjit Patel: Real gross value added growth seen at 7.7% for January-March; Real gross value added growth seen at 7.4% for FY19

Urjit Patel: Real gross value added growth seen at 6.4% for July-September, 7.1% for October-December

Urjit Patel: CPI inflation for Jan-March, Apr-Jun 2018 quarters seen at 4.6%

Implementation of GST has rendered short-term prospects uncertain.

Price pressures have co-incided with global geopolitical uncertainties

RBI Deputy governor Viral Acharya: * Market-friendly reforms include operational flexibility for exporters and importers, review of various FDI policies.

* Corporate credit risk profile is showing gradual signs of improvement

* Recent headline inflation has risen substantially in recent months

* Loss of momentum in growth has energised a lively debate

* Large distressed borrowers being directed into NCLT U/Insolvency Code

RBI Deputy governor N S Vishwanathan

* Committee recommended to move towards an external benchmark.

* Few banks have marginally brought down their base rate recently.

RBI Deputy governor B P Kanungo

* Government, RBI have been trying to broaden participation in the G-sec market

* Targetting active consolidation of state debt via buybacks and switches.

* The central bank has cut statutory liquidity ratio (SLR) by 50 bps to 19.50 per cent from October 14, while Held-To-Maturity (HTM) limit will be cut to 19.5 per cent in phases.

* The Monetary Policy Committee said that it is committed to keep CPI inflation close to 4 per cent on durable basis. CPI inflation was seen at 4.2 per cent in October-December, down from January-March's 4.6 per cent.

* Panel mooted switching to external benchmark for loan pricing; economic activity expected to recover led by services.

* MPC says imperative to reinvigorate investment activity

* GST-related teething problems may get resolved soon

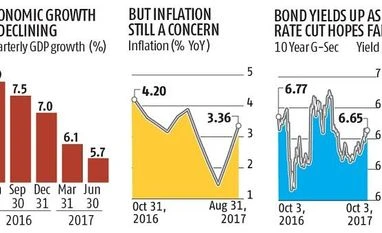

The following charts illustrate why the RBI analysts largely expected the central bank to maintain the status quo. Earlier, economists were of the view that inflation concerns could rule out any chance that the RBI will cut the repo again, after lowering it by 25 basis points to a 7-year low of 6 per cent at its last meeting in August, even as economic growth unexpectedly slowed to a three-year low of 5.7 per cent.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)