The country’s services activities fell for the first time in 13 months in May as demand remained subdued, showed the widely-tracked HSBC Purchasing Managers’ Index (PMI). This, coupled with the news of deficient rain, does not augur well, as almost three-fourth of the economy faces problems. In fact, a reason behind low orders were heat and earthquakes.

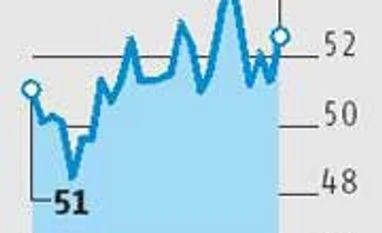

PMI was down to 49.6 points in May from 52.4 in April. PMI below 50 means contraction and that above 50 indicates expansion. May was the third month in a row to have witnessed a fall in PMI month-on-month, though in March and April, it was above 50 points.

PMI was down to 49.6 points in May from 52.4 in April. PMI below 50 means contraction and that above 50 indicates expansion. May was the third month in a row to have witnessed a fall in PMI month-on-month, though in March and April, it was above 50 points.

Before this, services contracted in April 2014. It is yet to be seen how PMI services will behave in the months to come, but Markit Economics, a financial information firm which compiles PMI data, tried not to over-read the data. “Although indicative of falling output, the latest reading pointed to a marginal rate of contraction,” it said.

In fact, service providers’ optimism was maintained in May, as improved marketing strategies and better economic conditions are expected to lead to business activity growth over the next year. Although the strongest in four months, the level of confidence was weaker than the series average.

The data is not in sync with the services sector data within the gross domestic product (GDP) figures, released recently. Services witnessed a double-digit growth in 2014-15, the highest pace since the new series of GDP data was launched in 2011-12.

Leading services declined due to reduction in incoming new work, the first since April 2014.

Competitive pressures and natural disasters were blamed for the decrease in new business inflows, according to Markit Economics.

Pollyanna De Lima, a Markit economist, said: “Restrained demand accompanied by sweltering heat and the earthquake led to falling new work. Nonetheless, the sector is expected to see a rebound in coming months, as these factors fade away.”

Undeterred by a weaker demand, Indian services companies hired additional workers in May. However, the rate of job creation was fractional, as a vast majority of survey participants signalled unchanged levels of staffing.

PMI manufacturing rose to 52.6 points in May from 51.3 in April as such composite PMI output index fell to a seven-month low of 51.2 points in May from 52.5 in April.

In China, manufacturing contracted for a third month in a row, while services continued to rise in May, according to the PMI survey.

Indian services providers reported rising cost burdens in May. The increase in input prices gathered pace in April but was weaker than the long-run survey average.

Higher salaries paid to staff and rising petrol costs were the main reasons reported by panelists for the latest increase in average input prices. With inflation also accelerating at manufacturers, the overall increase in costs across the private sector quickened.

Concurrently, output prices in the private sector increased further, with the rate of charge inflation strongest in 13 months. This might justify the cautious stance of the Reserve Bank of India, while reducing the policy rate by 0.25 percentage points on Tuesday.

)