The year 2016 has been one of shattered dreams and missed opportunities for the consumer goods sector. Demonetisation has destroyed the hope that the sector will come out of a poor demand cycle and the volume will grow.

Stakeholders in the consumer goods sector usually gather at the end of each year to assess their performance in the past 12 months. In 2016, it will be a more important meeting than ever before because the scrapping of high-value notes has led to a severe cash crunch, leaving little money in the hands of the consumer to spend.

However, even before the note ban, consumer goods companies were not seeing their products flying off the shelf.

In 2014 and 2015, the consumer market in India faced low growth due to the monsoon being weak, and consequently lower farm output, not enough increase in minimum support prices (MSP) for agri-commodities and cuts in the public expenditure on job creation, leaving little surplus cash in rural India.

By the end of July this year, the outlook changed from pessimism to optimism because the monsoon was good. The average rainfall was at 97 per cent of the long-term average compared to 86 per cent in 2015. Hopes of a better year in terms of consumption surged. A country in which nearly 870 million people, or 70 per cent of the total, reside in rural areas, a good harvest means more consumption.

The weakness is visible in the volume of Hindustan Unilever, the largest fast-moving consumer goods (FMCG) player. It dipped by one per cent in the September quarter after growing a tepid four per cent during the preceding two quarters. Marico, Dabur and Colgate-Palmolive did slightly better with the volume growing by 3.4 to 4.5 per cent during last quarter.

Between January and September, the personal care and household care segments posted marginally better growth at five per cent and six per cent, respectively, compared to the three per cent each in 2015. Growth in food and beverages remained at par with the same period last year at five per cent, driven by urban consumption.

A recovery in durables began in the form of higher demand for air-conditioners (ACs) as early as in February, with the demand being in the south and the west. Sales of summer products like cold beverages, ice-creams, air-coolers and refrigerators surged.

The India Meteorological Department’s prediction of a hotter summer than earlier increased optimism. Firms such Coca-Cola, Voltas, LG, Blue Star and Usha, among others, saw their sales beating those of preceding years. The announcement of pay hikes, recommended by the Seventh Pay Commission, was expected to increase sales of consumer durables and other big-ticket items during the second half of 2016. However, the data show till September growth in the fast-moving consumer goods (FMCG) space remained inadequate. Volume growth was lower during April-June and July-September compared to 2015, on a year-on-year basis. Analysts said as the market was recovering from a mid-term consumption slump, higher growth was awaited in the last three months of the year.

According to Rajat Wahi, partner, KPMG, the year was relatively tough for the sector even though consumption was going up in October as the benefits of the pay hike and a good monsoon began to kick in.

Quick-service restaurants saw some recovery in the early part of the second half. Sales of Pizza Hut and KFC grew by six and 13 per cent, respectively, in the September quarter. Largest player Jubilant FoodWorks’ (which owns Dominos Pizza) same-store growth went up 4.2 per cent from 3.2 per cent year-on-year.

Sales of durable items like ACs and washing machines grew up to 25 per cent during early 2016. In September and October sales of televisions and refrigerators surged because of the festive season. The two categories were estimated to post double-digit growth in 2016 after two years.

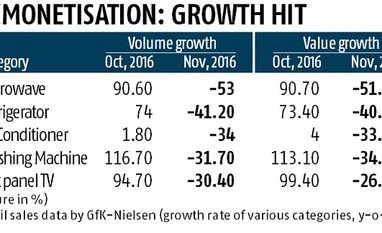

Following demonetisation, sales of durables fell sharply. The FMCG sector too suffered with sales going down by up to 60 per cent for many discretionary items.

The Consumer Electronics and Appliances Manufacturers Association (CEAMA), the industry body for major durables firms in the country, says the projected figures across categories are subject to change due to demonetisation. “The 2016 festive season has been the best since 2012 on the back of a healthy monsoon and the 7th pay commission handout to government employees. However, demonetisation has largely affected the sales performance of the durables industry. With almost 70% of the white goods market driven by cash, it was inevitable that the market would a drop in sales. The industry is under stress. White goods such as televisions, washing machine will surely see a downfall of 70%,” said Manish Sharma, president, CEAMA, and president and CEO of Panasonic, India and South Asia.

Sales fell because consumers postponed buying, but that may be compensated next year as liquidity improves. Experts say the decline in sales of FMCGs may not be recovered in the coming quarters because they comprise mostly products ready to be consumed. As the effect of the note ban may last till early 2017, manufacturers have cut production due rising inventories, both in FMCG and consumer durables. “The next quarter will be crucial. A fresh offtake at the distribution level would not be easy to come by as most trade partners have lost business,” said Pinakiranjan Mishra, partner, EY.

According to Abheek Singhi, senior partner and director, The Boston Consulting Group, FMCG players may have to come up with more attractive offerings in terms of price and cost to increase sales. While the ad spend has come down due to demonetisation, firms may increase promotional activities. As the prospect of growth in tier II and III is brighter than in larger towns, companies would have to continue supplying such market directly, moving away from wholesale trade to feeding them through own distribution network.

Stakeholders in the consumer goods sector usually gather at the end of each year to assess their performance in the past 12 months. In 2016, it will be a more important meeting than ever before because the scrapping of high-value notes has led to a severe cash crunch, leaving little money in the hands of the consumer to spend.

However, even before the note ban, consumer goods companies were not seeing their products flying off the shelf.

In 2014 and 2015, the consumer market in India faced low growth due to the monsoon being weak, and consequently lower farm output, not enough increase in minimum support prices (MSP) for agri-commodities and cuts in the public expenditure on job creation, leaving little surplus cash in rural India.

By the end of July this year, the outlook changed from pessimism to optimism because the monsoon was good. The average rainfall was at 97 per cent of the long-term average compared to 86 per cent in 2015. Hopes of a better year in terms of consumption surged. A country in which nearly 870 million people, or 70 per cent of the total, reside in rural areas, a good harvest means more consumption.

The weakness is visible in the volume of Hindustan Unilever, the largest fast-moving consumer goods (FMCG) player. It dipped by one per cent in the September quarter after growing a tepid four per cent during the preceding two quarters. Marico, Dabur and Colgate-Palmolive did slightly better with the volume growing by 3.4 to 4.5 per cent during last quarter.

Between January and September, the personal care and household care segments posted marginally better growth at five per cent and six per cent, respectively, compared to the three per cent each in 2015. Growth in food and beverages remained at par with the same period last year at five per cent, driven by urban consumption.

A recovery in durables began in the form of higher demand for air-conditioners (ACs) as early as in February, with the demand being in the south and the west. Sales of summer products like cold beverages, ice-creams, air-coolers and refrigerators surged.

The India Meteorological Department’s prediction of a hotter summer than earlier increased optimism. Firms such Coca-Cola, Voltas, LG, Blue Star and Usha, among others, saw their sales beating those of preceding years. The announcement of pay hikes, recommended by the Seventh Pay Commission, was expected to increase sales of consumer durables and other big-ticket items during the second half of 2016. However, the data show till September growth in the fast-moving consumer goods (FMCG) space remained inadequate. Volume growth was lower during April-June and July-September compared to 2015, on a year-on-year basis. Analysts said as the market was recovering from a mid-term consumption slump, higher growth was awaited in the last three months of the year.

According to Rajat Wahi, partner, KPMG, the year was relatively tough for the sector even though consumption was going up in October as the benefits of the pay hike and a good monsoon began to kick in.

Quick-service restaurants saw some recovery in the early part of the second half. Sales of Pizza Hut and KFC grew by six and 13 per cent, respectively, in the September quarter. Largest player Jubilant FoodWorks’ (which owns Dominos Pizza) same-store growth went up 4.2 per cent from 3.2 per cent year-on-year.

Sales of durable items like ACs and washing machines grew up to 25 per cent during early 2016. In September and October sales of televisions and refrigerators surged because of the festive season. The two categories were estimated to post double-digit growth in 2016 after two years.

Following demonetisation, sales of durables fell sharply. The FMCG sector too suffered with sales going down by up to 60 per cent for many discretionary items.

The Consumer Electronics and Appliances Manufacturers Association (CEAMA), the industry body for major durables firms in the country, says the projected figures across categories are subject to change due to demonetisation. “The 2016 festive season has been the best since 2012 on the back of a healthy monsoon and the 7th pay commission handout to government employees. However, demonetisation has largely affected the sales performance of the durables industry. With almost 70% of the white goods market driven by cash, it was inevitable that the market would a drop in sales. The industry is under stress. White goods such as televisions, washing machine will surely see a downfall of 70%,” said Manish Sharma, president, CEAMA, and president and CEO of Panasonic, India and South Asia.

Sales fell because consumers postponed buying, but that may be compensated next year as liquidity improves. Experts say the decline in sales of FMCGs may not be recovered in the coming quarters because they comprise mostly products ready to be consumed. As the effect of the note ban may last till early 2017, manufacturers have cut production due rising inventories, both in FMCG and consumer durables. “The next quarter will be crucial. A fresh offtake at the distribution level would not be easy to come by as most trade partners have lost business,” said Pinakiranjan Mishra, partner, EY.

According to Abheek Singhi, senior partner and director, The Boston Consulting Group, FMCG players may have to come up with more attractive offerings in terms of price and cost to increase sales. While the ad spend has come down due to demonetisation, firms may increase promotional activities. As the prospect of growth in tier II and III is brighter than in larger towns, companies would have to continue supplying such market directly, moving away from wholesale trade to feeding them through own distribution network.

)