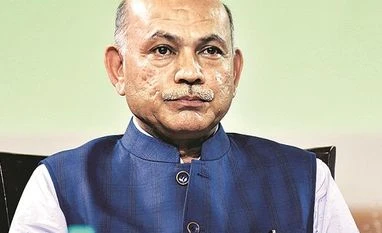

Despite 40% of the full fiscal year’s collection target falling on the remaining two months of 2019-20, Central Board of Direct Taxes Chairman P C MODY tells Dilasha Seth in a post-Budget interaction that he is optimistic. Edited excerpts:

Although the direct tax collection growth target for the current fiscal has been scaled down to 2.9 per cent, from the earlier 17.3 per cent, isn't it still high, considering that growth is a negative 5-6 per cent so far?

There is a lot of realism in fixation of target. A three per cent rise is definitely achievable. Historically, the last quarter of any fiscal is where your highest collection comes. These already stand atRs 7.4 trillion today.

But, this means you need to still achieve 40 per cent of the current fiscal’s target in two months. Besides, advance tax collection might also be lower due to the revisions on account of corporation tax cuts.

We have already factored that in. We will match up with the final growth rate and I am confident of meeting my target. The dispute resolution scheme announced in the Budget — ‘Vivaad se Vishwas’ — will contribute to that.

Isn’t the next fiscal’s target of 12.7 per cent growth again unrealistic in some sense?

With the manner in which we are now using data analytics and artificial intelligence, the targets are very, very, realistic. More and more of reporting by reporting entities of the financial transactions of taxpayers and increasing synergy wikth the Central Board of Indirect Taxes and Customs in terms of exchange of information would definitely lead to more compliance.

The biggest disappointment for the markets was the quiet on LTCG (long-term capital gains). Did that figure in your pre-Budget discussions?

That was absolutely an unrealistic assumption to make. World over, capital gains is liable to tax. What was the big issue on that? You can expect the moon every time but...(laughs).

But, LTCG (tax) is not a big contributor to revenues.

It is not about what the government is getting from a particular head of income. What is important is that in the general scheme of things, what ought to be taxed, ought to be taxed.

Contrary to the objective of simplifying the personal income tax regime, the Budget announcement has made it much more complex. Unlike now, a new return filer might need to seek professional help to figure which regime is more beneficial.

That is a mis-impression. On the contrary, if you do not have exemptions or deductions to avail of, it needs a simple calculation of what your income is from different sources, calculating the tax at the prescribed rate, and you're done with it. It's only when the issue of exemptions and deductions come that the whole confusion starts -- whether I'm entitled to it or not and to what extent.

So, doing away with exemptions and deductions has been the stated policy of the government; it also got reflected in the corporation tax cut. The same thing has been carried over here. We are essentially looking at a simplified, straight, lean, simple structure for taxpayers to comply with. Besides, if you look at it from the context of tax disputes, they are essentially hovering around these exemptions and deductions.

With this, will people not move away from buying insurance products?

Certainly not. On the contrary, with higher disposable income in their hands, people can take their own call on what they want, which instrument they would like to go for.

Isn’t the Rs 40,000 crore of revenue forgone on account of the personal income tax cut an over-estimation? The reactions indicate there might not be many takers?

We have a profile of the taxpayers we have with us -- who would be in what bracket. Based on that, we made this prediction but we cannot know for sure. This is estimated revenue; the actual figure will depend upon the number of people opting for the new scheme. I feel, particularly the younger generation, those in the lower bracket, will definitely find it attractive, as it is easier to comply with.

With the third instalment of advance tax paid, how many companies or what percentage have opted for the lower (corporate) tax regime?

The largest number have opted for the lower tax regime, barring a few that had some accumulated Minimum Alternate Tax credit. Giving a percentage will be difficult at this point. The trend is that most companies are opting for a simple, clean system, which even individual taxpayers will want to have.

A day after the Budget, it was clarified that those non-resident Indians not paying taxes on income from India will now have to. What about brokers who use the Indian platform from overseas?

What you're earning outside, we are not taxing. We are only saying that whatever income arises in India, that will be touched. So, if you are using the Indian platform, it will be taxed in India.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)