He also said the Centre was confident of disinvestment proceeds comfortably overshooting the Budgeted Estimate.

“Fixing the banks and competing the unfinished task of strengthening the PSBs (public sector banks) is unquestionably one of the most important agenda (items) on the table. We have already announced the detailed recapitalisation plans, the idea being to ensure the ability of banks to support growth,” Jaitley said.

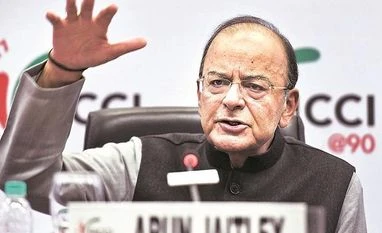

He was speaking at the Federation of Indian Chambers of Commerce and Industry’s annual general meeting here.

“We want the micro, small and medium enterprises sector to strengthen. This sector has been at the receiving end in the past few years, particularly with lending capacity of banks being depleted as a result of NPAs (non-performing assets). The lending capacity of banks will improve as capital adequacy improves,” the minister said.

The Centre is to issue the first tranche of Rs 1.35 lakh crore worth of bank recapitalisation bonds very soon. This tranche might consist of bonds having a 10-year tenure and an interest rate comparable to existing government securities, of around seven per cent.

These bonds, part of the two-year Rs 2.11 lakh crore recapitalisation programme, will be front-loaded over the next three to four quarters. Apart from the recap bonds, the Centre will cough up a total of Rs 18,000 crore this year and the next. The other Rs 58,000 crore the banks are to mobilise from the market.

The banks’ books are also cleaned with NPAs being taken to the National Company Law Tribunal under the insolvency and bankruptcy code.

“It is going to be the first year in history where we are going to significantly overtake the disinvestment target itself. In India, privatisation and disinvestment is the art of the possible,” Jaitley said.

The second such occasion of overshoot, in fact. In 2009-10, when the proceeds were Rs 25,000 crore, the Budgeted Estimate was Rs 1,120 crore. The total divestment target for 2017-18 is Rs 72,500 crore, the highest ever. The proceeds so far are Rs 52,500 crore, exceeding 2016-17’s Revised Estimate of Rs 45,500 crore.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)