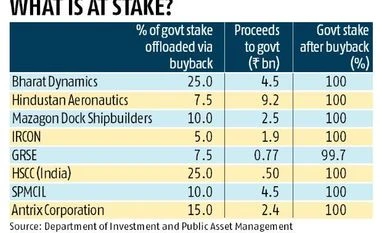

These companies are Bharat Dynamics and HAL (both before their recent initial public offerings), Mazagon Dock Shipbuilders, IRCON, Garden Reach Shipbuilders, HSCC India Ltd, SPMCIL, and Indian Space Research Organization (ISRO)’s commercial arm Antrix Corp.

Mazagon Dock, Garden Reach and IRCON are also up for IPOs while SPMCIL and HSCC India are candidates for ‘strategic sale’ (privatisation or closure) by the government.

“These PSUs bought back shares which led to a reduction in their outstanding shares, all of which continued being held by the centre. Hence the government’s stake in them remained at 100 per cent,” said a government official.

The centre has counted share buybacks by PSUs as part of disinvestment proceeds since 2016-17. A new set of new guidelines on capital restructuring of state-owned companies was released that year, which made them more accountable on matters of dividends, buybacks and bonuses and was expected to help the government meet its non-tax revenue and capital receipts target for the coming years.

On the matter of dividends, the guidelines stated that every PSU with a net-worth of at least Rs 20 billion and cash and bank balance of Rs 10 billion will exercise the option of buyback of shares. “It has been observed that CPSEs are not looking into merit-based capital restructuring including the option of buyback of shares if they do not have plans to deploy surplus funds optimally for business purposes,” the guidelines had stated.

For 2017-18, there have been three other listed PSUs that have bought back shares. In 2017-18. In total, 11 state-owned companies carried out share buybacks which added nearly Rs 50 billion to the divestment kitty.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)