With public sector banks raising Rs 10,000 crore through additional Tier I bonds in the last few weeks, the pressure on the government to provide them with capital support has eased.

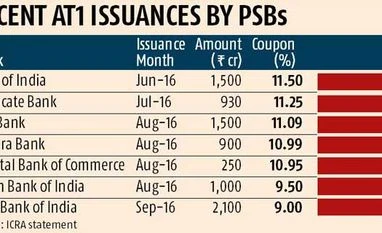

Rating agency ICRA said although the bonds lessened the government's burden, they were costly at coupon rates of 9-11.5 per cent, significantly higher than yields on senior bonds that trade at 7.5-9 per cent for ratings between AAA and A+ for tenures of 5-10 years.

In an earlier round, arrangers had to hold on to these bonds for a longer period than anticipated because of low investor appetite. This time, they have been able to place a sizeable amount with investors.

Karthik Srinivasan, senior vice-president, ICRA, Rs 8,100 crore of such bonds had been issued in 2016 and more banks were likely to explore this route. The State Bank of India also raised $300 million (Rs 2,100 crore) through overseas dollar-denominated bonds, taking the overall capital raised through additional Tier I bonds above Rs 10,000 crore. These bonds provide banks a cushion to time their efforts to raise equity capital, given valuations of most public sector banks are very low. ICRA said though the 1.5-2.5 percentage point higher yield on such paper was attractive, investors should keep in mind the risks associated were higher. These bonds are perpetual and the option to repay lies only with the bank issuing the bonds. Investors must rely on the secondary market for an exit.

Also, the risks for investors have increased with a number of these banks reporting losses and consequently depleting their distributable reserves.

Rating agency ICRA said although the bonds lessened the government's burden, they were costly at coupon rates of 9-11.5 per cent, significantly higher than yields on senior bonds that trade at 7.5-9 per cent for ratings between AAA and A+ for tenures of 5-10 years.

In an earlier round, arrangers had to hold on to these bonds for a longer period than anticipated because of low investor appetite. This time, they have been able to place a sizeable amount with investors.

Karthik Srinivasan, senior vice-president, ICRA, Rs 8,100 crore of such bonds had been issued in 2016 and more banks were likely to explore this route. The State Bank of India also raised $300 million (Rs 2,100 crore) through overseas dollar-denominated bonds, taking the overall capital raised through additional Tier I bonds above Rs 10,000 crore. These bonds provide banks a cushion to time their efforts to raise equity capital, given valuations of most public sector banks are very low. ICRA said though the 1.5-2.5 percentage point higher yield on such paper was attractive, investors should keep in mind the risks associated were higher. These bonds are perpetual and the option to repay lies only with the bank issuing the bonds. Investors must rely on the secondary market for an exit.

Also, the risks for investors have increased with a number of these banks reporting losses and consequently depleting their distributable reserves.

)