The Reserve Bank of India’s (RBI’s) move to push 12 large non-performing assets (NPAs) of the banking system into the insolvency process has created a massive business opportunity of up to Rs 2,500 crore for insolvency professionals.

To put the numbers in perspective, the RBI list comprises four companies with dues of over Rs 35,000 crore each. Even if one puts together all the few hundred cases handled by the six-month old framework, it would be a struggle to cross Rs 20,000 crore.

While the huge influx is likely to test the capacity of most players who are literally months old in the profession and present a steep learning curve, it will be a great stimulus for entry of stronger hands and investment in the segment.

According to the insolvency law, the entire process of corporate insolvency needs to be managed by a resolution professional appointed by a committee of creditors. The resolution professional, who will effectively become the chief executive officer of the business during the process period of 180 days, can charge a fee for his services. Besides, banks are also looking to appoint insolvency professionals to populate committees of creditors, which need to be formed for each of these companies.

With over Rs 2.5 lakh crore debt coming in the top 12 companies in the first list, a one per cent charge works out to Rs 2,500 crore. While this would be a ballpark figure, regulations do not prescribe a limit or range of fees, leaving a free hand for market forces. Globally, insolvency professionals work on various structures such as a fixed fee, time-and effort-based charges, or a percentage of realisation. In some cases, a combination of these three methods could also be used. Banks would have pricing power, but good insolvency professionals would have their levers to charge a decent number, given the complexities involved and short supply.

Pavan K Vijay, managing director of Corporate Professionals, a Delhi-based firm that is looking at this opportunity, says the move gives a big boost to the nascent profession. “Even if the one per cent number does not work out, as there are bound to be negotiations, it could be around Rs 1,500 crore to Rs 2,000 crore. It is not small.”

The State Bank of India (SBI), the country’s largest lender, which also has the lion’s share of these 12 large accounts, has begun the process of empanelling insolvency professionals by issuing advertisements recently.

“The bank (SBI) seeks to empanel IRPs (insolvency resolution professionals) as resolution professionals in applications filed before the National Company Law Tribunal for resolution and/or liquidation proceedings, including for representing the bank in the committee of creditors as per the provisions of the code/and the regulations,” said the advertisements issued early last week.

Other banks are likely to follow similar processes in selecting insolvency professionals, as the public sector is generally process-driven, regulatory officials say.

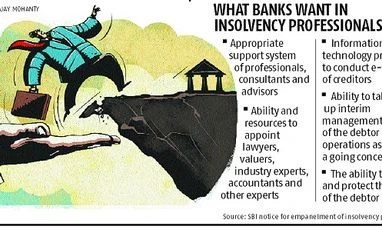

According to the Insolvency and Bankruptcy Board of India (IBBI) website, there were some 977 registered insolvency professionals in the inaugural limited period criteria and another 350 in the regular category, which requires passing the national insolvency examination. Lawyers, chartered accountants, and company secretaries form a majority. However, not all of them might be able to handle the large mandates. Given the large accounts it handles, the SBI has set stiff eligibility criteria for the applicants. It wants people with experience in debt restructuring, who are also experts in company law, etc. The application window closes early next week. Since the big accounts bring with them a lot of complexities, individual professionals might not be able to handle the entire task, Vijay said.

Several top lawyers such as Shardul Shroff and Pallavi Shroff of Shardul Amarchand Mangaldas, Alok Dhir of Dhir & Dhir, Bahram Vakil and Dushyant Dave are among the registered insolvency professionals. These would have established infrastructure and people to support their functions.

Also, the insolvency law provides for Insolvency Professional Entities (IPEs), which are corporate structures where two or more professionals can come together as partners or directors.

However, there are only seven such registered IPEs as of today, according to the IBBI website. These are IRR Insolvency Professionals, a firm floated by Delhi-based lawyer Alok Dhir, AAA Insolvency Professionals, Witworth Insolvency Professionals, Gyan Shree Insolvency Professionals, A2Z Insolvency Services, Turnaround Insolvency and Nangia Insolvency Professionals.

Sandeep Gupta of Witworth, which is already handling a few mandates, feels while the opportunity is big, capacity and capabilities also need to be built up. “It is the beyond the means of an individual to handle a book size of several thousand crores. A company of such a size would have numerous non-financial creditors as well. These need to be handled in a given time frame. The resolution professional would need adequate support in terms of people and infrastructure,” he said.

For instance, Gupta said, he might hire a few freelance chief financial officers to manage one of the big accounts. Considering all this, calculating fee on a percentage basis could be misleading. It should be calculated, based on time and effort put in by the insolvency professional, he argued.

The SBI advertisement asks applicants to provide “tentative fees proposed to be charged” for various roles such as interim resolution professional, resolution professional on behalf of the committee of creditors or for being appointed as an insolvency professional to represent the bank in the committee of creditors. The bank also wanted to know whether the applicant would be “willing to abide by the fees decided by the bank.”

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)