The Reserve Bank of India has relaxed rules for equity capital and inter-bank borrowings, taking note of concerns of small finance banks and payments banks.

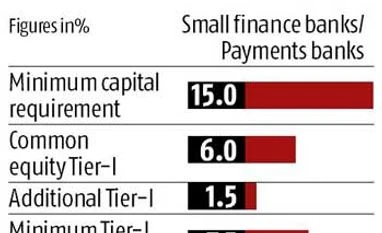

A year after issuing licences in principle for niche banks, the RBI has changed the rules on equity capital. These banks were required to maintain 7.5 per cent Tier-I equity capital, which now has been changed to 6 per cent till March 31 and 7 per cent after that. They have been allowed to raise additional Tier-1 capital up to 1.5 per cent of risk weighted assets.

“There is leeway for small finance banks maintaining Tier I equity capital. They have been allowed to issue additional Tier I bonds (1.5 per cent). So the minimum common equity I capital requirement is 6 per cent as against 7.5 per cent prescribed earlier. The overall Tier I capital requirement has been retained at 7.5 per cent,” said Karthik Srinivasan, senior vice-president, ICRA.

However, the minimum capital requirement for these banks has been kept higher at 15 per cent against 11 per cent (by 2019) for scheduled commercial banks. Experts said this was because they were lending mainly to those without access to financial services, where the perceived risk was higher. Apart from this, these new banks would not need to maintain the countercyclical capital buffer and the capital conservation buffer, unlike scheduled commercial banks.

“The exemption is only applicable to the legacy borrowings that are migrated to the opening balance sheet of the small finance bank on the day of commencement of operations,” the RBI said. Srinivasan said this would ease pressure on small finance banks to garner deposits in order to retire old loans.

The RBI has allowed payments banks to participate in the call money and CBLO markets as both borrowers and lenders. This will allow them easy access to funds and will also become an additional income channel. Payments banks have a limited scope of investment.

The RBI has clarified small finance banks cannot invest in securitised paper to meet priority sector lending. “Small finance banks will be permitted to participate in the securitisation market only as originators and providers of associated credit enhancements and liquidity supports,” the RBI notification said.

Small finance banks are required to lend 75 per cent to sectors classified as priority because the purpose of these new banks is to improve financial inclusion.

Sanjay Agarwal, managing director, Au Financiers, budding CFB, said three provisions in guidelines are beneficial for SFBs. First exemption from regulatory ceiling on inter-bank borrowing up to three years will give option to build liquidity profile. SFBs can continue to borrow from additional funds from banks, tempering need to take deposits from customers which may entail higher costs.

Second, while SFBs can’t invest in securitized paper, they have been allowed to buy loans. This would help to build credit book. And third, they get one more year to open 25 per cent of branches in un-banked areas as against initial requirement to meet norms on day one, he said.

Payments bank players have also given a thumbs up to the guidelines. “PBs are exempted from the requirement of having a base branch for a certain number of business correspondents (BCs), which is required for commercial banks. Another major takeaway is the fixed location that is set up to monitor the BCs in the area and address customer grievances will now be allowed to conduct banking business for PBs. This will help reduce the capex for setting up of brick and mortar branches,” said Rishi Gupta, MD & CEO, FINO PayTech.

The RBI has issued approval in principle to 10 small finance banks and 11 for payments banks. Small finance banks will undertake basic banking activities to the unserved and underserved sections of the population. Payments banks can accept deposits and provide small savings accounts and payments and remittance services but are not allowed to lend.

A year after issuing licences in principle for niche banks, the RBI has changed the rules on equity capital. These banks were required to maintain 7.5 per cent Tier-I equity capital, which now has been changed to 6 per cent till March 31 and 7 per cent after that. They have been allowed to raise additional Tier-1 capital up to 1.5 per cent of risk weighted assets.

“There is leeway for small finance banks maintaining Tier I equity capital. They have been allowed to issue additional Tier I bonds (1.5 per cent). So the minimum common equity I capital requirement is 6 per cent as against 7.5 per cent prescribed earlier. The overall Tier I capital requirement has been retained at 7.5 per cent,” said Karthik Srinivasan, senior vice-president, ICRA.

However, the minimum capital requirement for these banks has been kept higher at 15 per cent against 11 per cent (by 2019) for scheduled commercial banks. Experts said this was because they were lending mainly to those without access to financial services, where the perceived risk was higher. Apart from this, these new banks would not need to maintain the countercyclical capital buffer and the capital conservation buffer, unlike scheduled commercial banks.

“The exemption is only applicable to the legacy borrowings that are migrated to the opening balance sheet of the small finance bank on the day of commencement of operations,” the RBI said. Srinivasan said this would ease pressure on small finance banks to garner deposits in order to retire old loans.

The RBI has allowed payments banks to participate in the call money and CBLO markets as both borrowers and lenders. This will allow them easy access to funds and will also become an additional income channel. Payments banks have a limited scope of investment.

The RBI has clarified small finance banks cannot invest in securitised paper to meet priority sector lending. “Small finance banks will be permitted to participate in the securitisation market only as originators and providers of associated credit enhancements and liquidity supports,” the RBI notification said.

Small finance banks are required to lend 75 per cent to sectors classified as priority because the purpose of these new banks is to improve financial inclusion.

Sanjay Agarwal, managing director, Au Financiers, budding CFB, said three provisions in guidelines are beneficial for SFBs. First exemption from regulatory ceiling on inter-bank borrowing up to three years will give option to build liquidity profile. SFBs can continue to borrow from additional funds from banks, tempering need to take deposits from customers which may entail higher costs.

Second, while SFBs can’t invest in securitized paper, they have been allowed to buy loans. This would help to build credit book. And third, they get one more year to open 25 per cent of branches in un-banked areas as against initial requirement to meet norms on day one, he said.

Payments bank players have also given a thumbs up to the guidelines. “PBs are exempted from the requirement of having a base branch for a certain number of business correspondents (BCs), which is required for commercial banks. Another major takeaway is the fixed location that is set up to monitor the BCs in the area and address customer grievances will now be allowed to conduct banking business for PBs. This will help reduce the capex for setting up of brick and mortar branches,” said Rishi Gupta, MD & CEO, FINO PayTech.

The RBI has issued approval in principle to 10 small finance banks and 11 for payments banks. Small finance banks will undertake basic banking activities to the unserved and underserved sections of the population. Payments banks can accept deposits and provide small savings accounts and payments and remittance services but are not allowed to lend.

)