Citibank has ruled out setting up a subsidiary in India and has officially informed the Reserve Bank of India about its decision.

The banking regulator was hoping to convince a few foreign banks to operate in India through wholly-owned subsidiaries (WOSes). But, according to people familiar with the development, Citibank recently wrote to RBI saying it had no plans to establish a WOS in India at this point.

The central bank’s initial effort to persuade foreign lenders to convert their branches into subsidiaries (between March 2005 and March 2009) for better regulatory oversight had failed due to absence of adequate incentives. However, this time, in its new subsidiarisation norms released in November 2013, RBI promised near-national treatment to foreign banks that opted for a subsidiary mode of presence.

Though most foreign banks appear reluctant to establish a subsidiary here, Citi is the only bank that has so far communicated this to the regulator, in writing. The bank’s desire not to set up a WOS in India was mentioned in its recent periodic report to RBI.

Citi confirmed it had no plans to convert its India branches into a subsidiary. “At this point, Citi does not have plans to establish a local subsidiary,” a spokesperson for Citi told Business Standard in an e-mail.

Bankers felt the reciprocity clause in RBI’s guidelines probably deterred Citi from opting for a subsidiary mode of presence. According to the new norms, foreign banks will be given unfettered branch access in India after establishing a WOS, provided their home countries allow Indian lenders to open branches without much restrictions.The banking regulator was hoping to convince a few foreign banks to operate in India through wholly-owned subsidiaries (WOSes). But, according to people familiar with the development, Citibank recently wrote to RBI saying it had no plans to establish a WOS in India at this point.

The central bank’s initial effort to persuade foreign lenders to convert their branches into subsidiaries (between March 2005 and March 2009) for better regulatory oversight had failed due to absence of adequate incentives. However, this time, in its new subsidiarisation norms released in November 2013, RBI promised near-national treatment to foreign banks that opted for a subsidiary mode of presence.

Though most foreign banks appear reluctant to establish a subsidiary here, Citi is the only bank that has so far communicated this to the regulator, in writing. The bank’s desire not to set up a WOS in India was mentioned in its recent periodic report to RBI.

Citi confirmed it had no plans to convert its India branches into a subsidiary. “At this point, Citi does not have plans to establish a local subsidiary,” a spokesperson for Citi told Business Standard in an e-mail.

“Indian banks are not allowed to expand networks freely in the US. Citi, being a US-based bank, would have found it difficult to convince the regulator in getting a near-national treatment in branch expansion here,” said a banker who did not wish to be named.

Sources said uncertainty on stamp duty and certain areas of taxation, and the need for rural presence might also have influenced Citi’s decision.

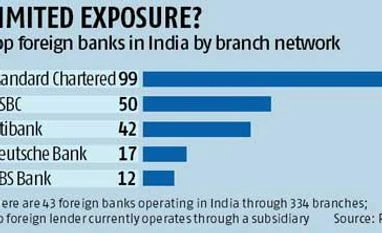

Bankers also pointed out that RBI had not made subsidiarisation mandatory for foreign banks that entered India before August 2010, leaving to many of them, including Citi, the option of not creating a WOS in India. According to RBI data, Citi opened its first branch in India in 1963. It currently has 42 branches across the country and three unused branch licences.

Hurdles for foreign banks in creating WOSes

* Near-national treatment in branch expansion not guaranteed due to reciprocity clause

* Need to have significant presence in rural/unbanked regions

* Lack of clarity on tax sops, stamp duty relaxation

)