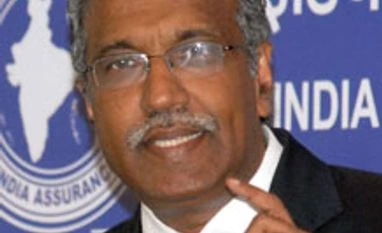

T S Vijayan, the chairman of the Insurance Regulatory and Development Authority (Irda), on Friday said the practice of imposing differential penalties on companies was a normal practice.

“The regulator weighs the gravity of violations by the insurer and then imposes a penalty. This (the amount) can be different from the one imposed on another company as only the maximum quantum of penalty, which is Rs 5 lakh, is defined under the law,” Vijayan said, when asked about the Central Bureau of Investigation (CBI) quizzing a former Irda chief with regards to the penalty imposed on a non-life insurance company.

CBI has started a probe into alleged undervaluation of penalty to the tune of nearly Rs 17,500 crore on Reliance General Insurance Company Limited by officials Irda in 2009.

Vijayan added whatever penalty was imposed, a detailed information on the quantum and justification was available in the public domain.

Talking about health insurance products, Vijayan said there was a need to have long-term products in this space as also savings linked to health insurance. Vijayan added the modalities for this are yet to be worked out.Vijayan was speaking at an insurance summit by National Insurance Academy.

“The regulator weighs the gravity of violations by the insurer and then imposes a penalty. This (the amount) can be different from the one imposed on another company as only the maximum quantum of penalty, which is Rs 5 lakh, is defined under the law,” Vijayan said, when asked about the Central Bureau of Investigation (CBI) quizzing a former Irda chief with regards to the penalty imposed on a non-life insurance company.

CBI has started a probe into alleged undervaluation of penalty to the tune of nearly Rs 17,500 crore on Reliance General Insurance Company Limited by officials Irda in 2009.

More From This Section

A Reliance General Insurance spokesperson termed the view that penalties of Rs 17,500 crore could have been imposed on it as “baseless, unfounded and devoid of any legal foundation”.

Vijayan added whatever penalty was imposed, a detailed information on the quantum and justification was available in the public domain.

Talking about health insurance products, Vijayan said there was a need to have long-term products in this space as also savings linked to health insurance. Vijayan added the modalities for this are yet to be worked out.Vijayan was speaking at an insurance summit by National Insurance Academy.

)