The six-member Monetary Policy Committee of the Reserve Bank of India (RBI) on Thursday kept the repo rate unchanged but raised the reverse repo rate by 25 basis points to narrow the corridor in which overnight money moves.

Economists said this was an indirect tightening of interest rates even as the policy stance remained neutral. The central bank also warned about rising inflation. Expected at 4.5 per cent in the first half of the current fiscal year, inflation could climb to 5 per cent in the second half, owing to risks and an unfavourable base effect.

Following the policy, the repo rate, at which banks borrow from the RBI, remained at 6.25 per cent, and the reverse repo rate, at which banks lend to the central bank, was revised to 6 per cent from 5.75 per cent.

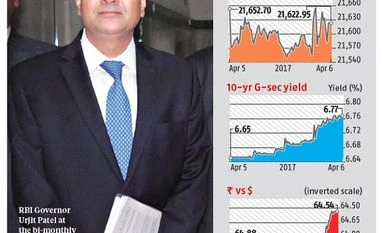

Following the announcement, overnight call rates closed 20 basis points higher, yields on the 10-year gilt rose 10 basis points to close at 6.77 per cent and the rupee strengthened to 64.53 to the dollar from its previous close of 64.88.

The call money rate, at which banks lend overnight money to each other, had fallen to 5.8 per cent due to excess liquidity in the system. The call money rate cannot fall below the reverse repo rate or rise higher than the repo rate because the central bank provides its facilities at these rates.

Narrowing the corridor gives the RBI tighter control, and ensures “finer alignment of the weighted average call rate”. The RBI had narrowed this corridor in its previous annual policy on April 2016 from 100 basis points to 50 basis points. Call money rates on Thursday adjusted from their day’s low of 5.85 per cent to close at 6.05 per cent, effectively raising interest rates in the economy by at least 20 basis points after the policy despite the liquidity situation.

“This could also be viewed as an indication of the RBI’s policy stance inching towards tightening from neutral,” said Devendra Pant, chief economist, India Ratings & Research. In its February policy, the RBI had shifted its stance from accommodative to neutral.

The main action point of the policy was around liquidity induced by the demonetisation drive. At its peak, banks had parked Rs 8 lakh crore with the RBI. The central bank had to absorb it to ensure “unclogged channels of monetary transmission”, RBI Governor Urjit Patel said in a interaction with the media after Thursday’s policy.

“Looking ahead, our endeavour would be to drain out the remaining liquidity overhang, manage the new drivers of liquidity in 2017-18, and ensure that the normal requirements of liquidity, consistent with a growing economy, are met,” Patel said.

This would be managed through a combination of reverse repo operations and secondary bond market purchases, he added.

The central bank is also in talks with the government to amend the RBI Act to introduce the standing deposit facility (SDF), which could allow un-collateralised liquidity operation by the RBI. “Introduction of this facility would give greater flexibility to the Reserve Bank for managing its liquidity operations,” the RBI said in a statement.

“The RBI’s clear articulation on liquidity management is welcome and will ensure stability in markets by enforcing the sanctity of the operating rate while addressing temporary liquidity imbalances,” said Chanda Kochhar, managing director and chief executive officer of ICICI Bank.

The RBI’s measures for developmental and regulatory policies such as “substitution of collateral under the liquidity adjustment facility, allowing banks to invest in real estate investment trusts and financial literacy will go a long way in improving the financial system”, said State Bank of India Chairman Arundhati Bhattacharya.

The RBI is committed to keeping consumer price-based inflation at 4 per cent, with a band of 2 per cent. “The move to 4 per cent is challenging,” said RBI Executive Director Michael Patra. “There are no lucky disinflationary forces on the horizon. The evolving outlook will decide how the RBI will move. But it is cautioning you that inflation is elevated relative to where we want it to be,” he added.

The central bank, though, is confident that economic growth will be robust. “GVA growth is projected to strengthen to 7.4 per cent in 2017-18 from 6.7 per cent in 2016-17, with risks evenly balanced,” the policy document said.

The RBI will also set up a revised prompt corrective action (PCA) framework, which is enforced on banks when they fall short in their capital adequacy ratio, net non-performing assets (NPA) ratio and return on assets. The central bank imposes severe restrictions on banks once the PCA is enforced. Also, banks would be allowed to invest in real estate investment trusts (REITS) and infrastructure investment trusts (InvITs), the policy document said. Capitalisation of banks, along with resolution of bad assets, remained high on the RBI’s agenda.

“Case-specific instruments will be required and a number of them will be introduced by the RBI. How to bring faster implementation of JLF (joint lenders’ forum) decisions, how to enhance the number or role of oversight committees, or whether to look at sectoral or size-specific approaches in achieving this resolution--these are the options that are being considered,” said RBI Deputy Governor SS Mundra.

The RBI also said it would allow substitute collateral in the liquidity operation window. So far, banks have been using gilts, but the RBI wants to increase the number of instruments available for mortgage. However, no details were provided except that the facility would become operational from April 17.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)