On Wednesday, RBI Governor D Subbarao said in a post-monetary policy interaction conference call with analysts and researchers that the central bank would respond to the evolving situation with all instruments at their command. These instruments also include bond sales to further drain liquidity.

However, Subbarao maintained that among the menu of options available to the central bank, sovereign bonds auction is the least preferred.

On Wednesday, the rupee recorded its biggest intra-day gain in calendar year 2013. The currency was about to touch a fresh all-time low, but dollar sales by state-run banks on behalf of RBI helped it recover. The rupee ended at 60.37 a dollar, compared with the previous close of 60.49. During intra-day trades, the currency touched a low of 61.17, very close to the all-time low of 61.22 registered on July 8. The rupee had opened at 60.86 on Wednesday.

“All the options are on the table and are under consideration and we are engaged in discussions with the government and we will do whatever is best,” said Subbarao.

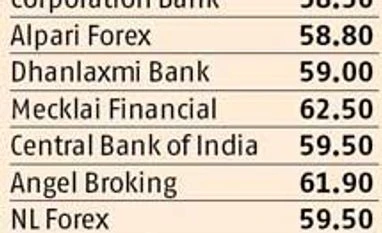

The median forecasts poll from 10 currency experts done by Business Standard shows the rupee is expected to trade at Rs 59.50 per dollar in a month’s time.

You’ve reached your limit of {{free_limit}} free articles this month.

Subscribe now for unlimited access.

Already subscribed? Log in

Subscribe to read the full story →

Smart Quarterly

₹900

3 Months

₹300/Month

Smart Essential

₹2,700

1 Year

₹225/Month

Super Saver

₹3,900

2 Years

₹162/Month

Renews automatically, cancel anytime

Here’s what’s included in our digital subscription plans

Exclusive premium stories online

Over 30 premium stories daily, handpicked by our editors

Complimentary Access to The New York Times

News, Games, Cooking, Audio, Wirecutter & The Athletic

Business Standard Epaper

Digital replica of our daily newspaper — with options to read, save, and share

Curated Newsletters

Insights on markets, finance, politics, tech, and more delivered to your inbox

Market Analysis & Investment Insights

In-depth market analysis & insights with access to The Smart Investor

Archives

Repository of articles and publications dating back to 1997

Ad-free Reading

Uninterrupted reading experience with no advertisements

Seamless Access Across All Devices

Access Business Standard across devices — mobile, tablet, or PC, via web or app

)