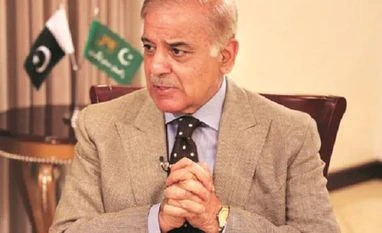

Prime Minister Shehbaz Sharif on Thursday alleged that Imran Khan wanted Pakistan to face a similar situation like Sri Lanka and said the decisions of the previous government led by the cricketer-turned-politician was responsible for the current economic crisis.

In August, Pakistan took a sigh of relief as the International Monetary Fund (IMF) approved the revival of its Extended Fund Facility programme after which the cash-strapped country will receive the 7th and 8th tranche of USD 1.17 billion.

However, Sharif said the country was paying the price for the confusion created by the erstwhile regime headed by Khan.

They made agreements with the IMF on their own and later ripped apart the conditions, Sharif said while addressing a press conference on Thursday, adding: The-then finance minister [Shaukat Tarin] created confusion.

Pakistan and the IMF had signed the USD 6 billion deal in July 2019 but the programme was derailed in January 2020 and restored briefly in March last year before again going off the track in June.

The present government which got power in April this year after toppling Khan's government began an effort to revive the programme.

Also Read

The global lender also approved to increase the loan size to around USD 7 billion and extend it till June 2023.

Khan wanted Pakistan to face a similar situation like Sri Lanka, Sharif alleged.

Sri Lanka is facing the worst economic crisis since independence in 1948, which has led to an acute shortage of essential items like food, medicine, cooking gas and fuel across the country.

The unprecedented protests led to the ouster of the powerful Rajapaksa family from power.

In September, the IMF came to the rescue of the bankrupt island nation, by providing a loan of about USD 2.9 billion over four years under a preliminary agreement.

Meanwhile, the cataclysmic floods that have displaced 33 million and killed over 1,700 has put further pressure on Pakistan's sluggish economy.

The country's teetering economy is facing a balance of payments crisis, a ballooning current account deficit, and inflation hitting an all-time high of 27 per cent.

Last month, the US unveiled a roll-over agreement to suspend payments of USD 132 million of Pakistan's debt.

In August, New York-based rating agency S&P Global revised Pakistan's long-term ratings from 'stable' to 'negative' given the spiralling inflation and tighter global financial conditions.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)