Japan's economy expanded at a rapid clip at the start of the year, the first hard evidence that Prime Minister Shinzo Abe's sweeping stimulus is beginning to rouse consumers and businesses into action even as risks loomed in the horizon.

Corporate investment, seen as an essential ingredient of a sustained recovery, fell for the fifth consecutive quarter though analysts expect improved business sentiment will eventually translate into more spending.

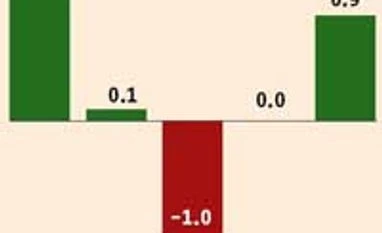

Gross domestic product rose 0.9 per cent from the previous quarter, against the median forecast of a 0.7 per cent rise in a Reuters poll of 24 analysts.

That translated into an annualised 3.5 per cent growth, the fastest in a year, and topped a 1 per cent rise in the fourth quarter, cementing a turnaround from six months of contraction in 2012.

It also outpaced US growth in the same period for the second straight quarter. The last time Japan's growth trumped that of the world's biggest economy was in the first quarter of 2012.

"Personal consumption was really strong and exports did better than expected. Stock gains and expectations for higher salaries are driving consumption now," said Hiroaki Muto, senior economist at Sumitomo Mitsui Asset Management Co. in Tokyo. The Cabinet Office data - which covers the first full quarter since Abe's return to power in late December - is viewed as the first comprehensive report card on his plan to revive the world's third-largest economy.

Victory would give his Liberal Democrat Party control of both houses of parliament.

The first quarter gain mainly reflects the psychological effects of improved expectations boosting domestic demand as households responded to the wealth-creating effects of a soaring stock market.

Abe is hoping to jolt the economy out of its two-decade long slumber with his "Abenomics" policy mix of unprecedented monetary stimulus, extra budget spending and promised pro-growth policies, and analysts expect those efforts to pay off in months ahead.

Sumitomo Mitsui's Muto said that despite a slow recovery in capital expenditure the economy should maintain its momentum.

"The GDP data would suggest that things are going well for Prime Minister Shinzo Abe heading into the upper house election."

The key to more lasting improvement will be whether the benefits reaped by exporters from the yen's rapid retreat will filter through to a broader economy, kicking off a virtuous cycle of more jobs, higher wages, profits and investment.

This is crucial if Abe's gamble is to pay dividends, with critics questioning the Bank of Japan's plan to flood the economy with money to the tune of $1.4 trillion in two years.

The BOJ's plan to double its government debt holdings has sent the yen sharply lower against the dollar and boosted share prices by 70 per cent since last November, as Tokyo banks on Japan's export-reliant economy kicking into high gear on the back of a cheap currency.

Economists say companies, still cautious about their future, should start spending more in the current quarter.

"There is certain demand for capex among companies as exports are expected to recover, some firms need to update their facilities and there will be positive effect from the government's extra budget. I think capital spending will rise in April-June," said Yuichi Kodama, chief economist at Meiji Yasuda Life Insurance.

Sales tax

Capital spending fell 0.7 per cent in the quarter, defying expectations of a 0.7 per cent increase, weighing a Tokyo stock market that was initially buoyed by gains on Wall Street and a weaker yen.

Investors will closely watch data for core machinery orders due to be released on Friday and expected to show a 2.8 per cent increase in March, as well as companies' forecasts for the following quarter.

Private consumption, which accounts for roughly 60 per cent of the economy, rose 0.9 per cent as expected and was up for a second consecutive quarter, reflecting the better consumer mood helped in part by a buoyant stock market.

Exports, helped by the yen's retreat to 4-1/2-year lows against the dollar, beat expectations, making a 0.4 per cent net contribution to GDP, despite higher import costs caused by a weaker currency.

Economics Minister Akira Amari said the GDP data showed the economy appears to be developing favorable conditions for a planned sales tax hike from April 2014, although a final decision will be made after second quarter data, due in August.

"We got off to a good start," Amari told reporters. "We'd like to develop conditions ... towards autumn."

Risks

There are still some risks to the favorable scenario painted by the latest data.

Japan's ageing and shrinking population poses a challenge to Abe's yet-to-be articulated plans to squeeze more growth out of the mature, highly developed economy.

Consumer spending could also suffer from rising costs of energy and imported goods unless the summer round of bonuses boosts incomes enough to make up for a squeeze in disposable incomes.

Another source of concern is an uncertain global outlook, underlined recently by a string of weak data from the US and China, Japan's two biggest export markets.

Abe also has yet to deliver pro-growth reforms, considered necessary to bring back long-term solid growth that has eluded Japan for the past two decades.

There are also heightened worries over rising interest rates in the government bond market, which could undermine the BOJ's policies and refocus attention on Japan's huge public debt burden worth more than twice the size of its economy.

Yet the tailwind of extra stimulus spending is expected to sustain the momentum at least for the remainder of this year.

"The economy will enjoy strong growth for another year or so. It's no longer just about brightening sentiment and rises in equities prices. There's now proof that Abenomics is working and that the economy is on a solid footing," said Yoshiki Shinke, senior economist at Dai-Ichi Life Research Institute in Tokyo.

Corporate investment, seen as an essential ingredient of a sustained recovery, fell for the fifth consecutive quarter though analysts expect improved business sentiment will eventually translate into more spending.

Gross domestic product rose 0.9 per cent from the previous quarter, against the median forecast of a 0.7 per cent rise in a Reuters poll of 24 analysts.

That translated into an annualised 3.5 per cent growth, the fastest in a year, and topped a 1 per cent rise in the fourth quarter, cementing a turnaround from six months of contraction in 2012.

It also outpaced US growth in the same period for the second straight quarter. The last time Japan's growth trumped that of the world's biggest economy was in the first quarter of 2012.

"Personal consumption was really strong and exports did better than expected. Stock gains and expectations for higher salaries are driving consumption now," said Hiroaki Muto, senior economist at Sumitomo Mitsui Asset Management Co. in Tokyo. The Cabinet Office data - which covers the first full quarter since Abe's return to power in late December - is viewed as the first comprehensive report card on his plan to revive the world's third-largest economy.

Victory would give his Liberal Democrat Party control of both houses of parliament.

The first quarter gain mainly reflects the psychological effects of improved expectations boosting domestic demand as households responded to the wealth-creating effects of a soaring stock market.

Abe is hoping to jolt the economy out of its two-decade long slumber with his "Abenomics" policy mix of unprecedented monetary stimulus, extra budget spending and promised pro-growth policies, and analysts expect those efforts to pay off in months ahead.

Sumitomo Mitsui's Muto said that despite a slow recovery in capital expenditure the economy should maintain its momentum.

"The GDP data would suggest that things are going well for Prime Minister Shinzo Abe heading into the upper house election."

The key to more lasting improvement will be whether the benefits reaped by exporters from the yen's rapid retreat will filter through to a broader economy, kicking off a virtuous cycle of more jobs, higher wages, profits and investment.

This is crucial if Abe's gamble is to pay dividends, with critics questioning the Bank of Japan's plan to flood the economy with money to the tune of $1.4 trillion in two years.

The BOJ's plan to double its government debt holdings has sent the yen sharply lower against the dollar and boosted share prices by 70 per cent since last November, as Tokyo banks on Japan's export-reliant economy kicking into high gear on the back of a cheap currency.

Economists say companies, still cautious about their future, should start spending more in the current quarter.

"There is certain demand for capex among companies as exports are expected to recover, some firms need to update their facilities and there will be positive effect from the government's extra budget. I think capital spending will rise in April-June," said Yuichi Kodama, chief economist at Meiji Yasuda Life Insurance.

Sales tax

Capital spending fell 0.7 per cent in the quarter, defying expectations of a 0.7 per cent increase, weighing a Tokyo stock market that was initially buoyed by gains on Wall Street and a weaker yen.

Investors will closely watch data for core machinery orders due to be released on Friday and expected to show a 2.8 per cent increase in March, as well as companies' forecasts for the following quarter.

Private consumption, which accounts for roughly 60 per cent of the economy, rose 0.9 per cent as expected and was up for a second consecutive quarter, reflecting the better consumer mood helped in part by a buoyant stock market.

Exports, helped by the yen's retreat to 4-1/2-year lows against the dollar, beat expectations, making a 0.4 per cent net contribution to GDP, despite higher import costs caused by a weaker currency.

Economics Minister Akira Amari said the GDP data showed the economy appears to be developing favorable conditions for a planned sales tax hike from April 2014, although a final decision will be made after second quarter data, due in August.

"We got off to a good start," Amari told reporters. "We'd like to develop conditions ... towards autumn."

Risks

There are still some risks to the favorable scenario painted by the latest data.

Japan's ageing and shrinking population poses a challenge to Abe's yet-to-be articulated plans to squeeze more growth out of the mature, highly developed economy.

Consumer spending could also suffer from rising costs of energy and imported goods unless the summer round of bonuses boosts incomes enough to make up for a squeeze in disposable incomes.

Another source of concern is an uncertain global outlook, underlined recently by a string of weak data from the US and China, Japan's two biggest export markets.

Abe also has yet to deliver pro-growth reforms, considered necessary to bring back long-term solid growth that has eluded Japan for the past two decades.

There are also heightened worries over rising interest rates in the government bond market, which could undermine the BOJ's policies and refocus attention on Japan's huge public debt burden worth more than twice the size of its economy.

Yet the tailwind of extra stimulus spending is expected to sustain the momentum at least for the remainder of this year.

"The economy will enjoy strong growth for another year or so. It's no longer just about brightening sentiment and rises in equities prices. There's now proof that Abenomics is working and that the economy is on a solid footing," said Yoshiki Shinke, senior economist at Dai-Ichi Life Research Institute in Tokyo.

)