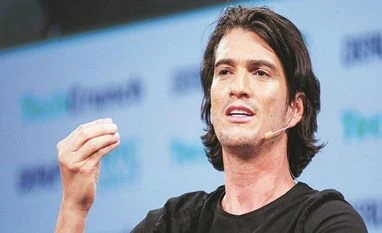

Adam Neumann has said his mission as WeWork’s chief executive is to elevate the world’s consciousness. Members of his board are now discussing a plan to elevate someone else to run the company and salvage its troubled initial public offering.

The board plans to meet on Monday, people familiar with the situation said. There, some directors are expected to raise the prospect of Neumann stepping down as CEO and becoming non-executive chairman, said the people, who asked not to be identified because the discussions are private.

With the drama of a palace coup, Neumann has found himself at odds with WeWork’s largest investor, Masayoshi Son, founder of Japanese conglomerate SoftBank, who is among those pushing for Neumann to resign, a person familiar with the situation said, after widespread criticisms of the company’s governance and spending. The choice is ultimately Neumann’s, though, as the 40-year-old CEO maintains effective control of management decisions.

The boardroom infighting not only imperils the IPO but also a $6 billion loan contingent on the deal. The unprofitable company must complete a successful stock offering before the end of the year to keep access to the credit facility.

WeWork conceded last week that its plans for going public would have to wait after talks with potential investors lowered expectations for the company’s planned IPO valuation to $15 billion or less, after a previous valuation of $47 billion. Among the concerns they voiced: Neumann’s controversial style and control of the company.

Rarely has so much gone so wrong so fast for a young company in the spotlight.

“It’s Uber-scale mess,” said Kellie McElhaney, a professor at the University of California Berkeley’s Haas School of Business, who blames both the board and Neumann for not learning from that company’s earlier mistakes. “He’s really taken a first-mover advantage that WeWork had in the space and blown it in a big way.” The WeWork story is beginning to fit squarely into the era of unicorn capitalism: A young and charismatic entrepreneur disrupts an industry, runs afoul of elders and investors, sometimes winning but sometimes failing to live up to their own hype.

Institutions including Benchmark Capital, one of WeWork’s investors, pushed out Uber Technologies’ Travis Kalanick before the ride-hailing company went public.

Still, even if some directors want to oust Neumann, it won’t be easy given the company’s governance structure. Based on the number of shares he controls and their unique super-voting rights, Neumann has the power to get rid of the entire board on his own, according to the prospectus.

Softbank’s intervention in the WeWork saga comes as the biggest backers of the company’s gargantuan Vision Fund are reconsidering how much to commit to its next investment vehicle. Saudi Arabia’s Public Investment Fund, which contributed $45 billion to the $100 billion Vision Fund, is now only planning to reinvest profits from that vehicle into its successor, people familiar said last week. Abu Dhabi’s Mubadala Investment Co., which invested $15 billion, is considering paring its future commitment to below $10 billion, the people said.

Week of Uncertainty

The news of Neumann’s potential ouster comes after a whirlwind week of uncertainty for WeWork. Banks that provided a $500 million credit line to Neumann are looking to revise the terms as the company’s struggle to go public casts doubt on the value of his collateral, people briefed on the discussions said last week. It’s not clear what changes they may seek, or what right they may have to make demands.

On Friday, Wendy Silverstein, a big name in New York commercial real estate who joined WeWork last year as head of its property investment arm, left the company. She’s spending time caring for her elderly parents.

Even the president of the Federal Reserve Bank of Boston was adding to the angst. In a speech Friday in New York, Eric Rosengren warned that the proliferation of co-working spaces might pose new risks to financial stability.

“I’ve never seen a company of this size and scale generate such a consensus of negative opinion in my long, long life of following IPOs,” said Len Sherman, a Columbia Business School adjunct professor whose 30-year business career included time as a senior partner at consulting firm Accenture Plc. “There is no box that they haven’t ticked when you think of all the reasons that you might be very concerned -- like blaring red lights. Like, oh my gosh, caution, danger, danger.”

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)