Yields on similar-maturity debt by Italy led euro-area moves, climbing as much as five basis points before pulling back. Global bonds have had a wild month, with yields gyrating as investors reassessed their expectations for the path of rate hikes as inflation quickens.

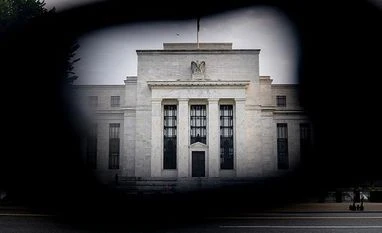

The Treasury market has seen unusually large price swings as liquidity dried up, by one measure to the worst since peak investor pandemic fears in March 2020. “Investors and Fed policy makers are still unsure as to whether elevated inflation will be transitory or not,” said Kenta Inoue, a senior market economist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)