Timex Group, the US-based watch giant, has had a chequered past in India since its entry in the late-1980s. Timex Group India (Timex), its Indian arm, is looking to align its business with the global image of a sturdy, outdoorsy watch brand, that rides on technology.

Timex has moved from double-digit market shares to single digits now, weathering a split from JV partner, Titan Industries through 1998-2000, building its own distribution network, manufacturing units therafter, premiumising its product range, and even entering the luxury and fashion segments in branded watches. From posting profits a few year back, it ran into Rs 41.96 crore of losses in 2012-13.

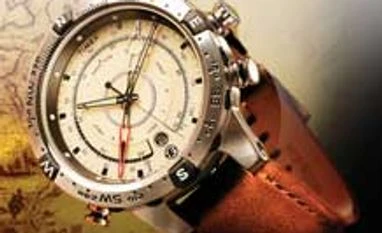

But course corrections are coming through now. Timex will start with bringing in more high value models from its global portfolio that add to profitability, according to M K Bandyopadhyay, managing director, Timex Group India. Watches which will be reminiscent of the global branding, 'Timex - It Takes a Licking and Keeps on Ticking', by being sporty and macho.

In its initial days, Timex had focused on the lower end of the market, targetting the unorganised segment. After the split, it gradually began manufacturing and moving into the Rs 600-7,000 space and lately, even imported Rs 10,000-5 lakh fashion and luxury brands such as Nautica and Versace. In a hat-tip to the Indian market, it has two India-specific lines, Helix by Timex and a licensed line by Tarun Tahiliani. Helix launched in 2011 was meant for the youth, much like Titan's Fastrack.

The group will rationalise its portfolio in the mid-premium or fashion segment. For example, the head of retail and fashion brand, Angelique O'Brien, says, "A Rs 10,000 price-point watch cannot sell everywhere, so we are withdrawing our brand called Marc Ecko, by way of a corrective measure." Timex will continue with its other exclusive licensed brands such as fashion brands Nautica (Rs 8,500-21,500) and Tarun Tahiliani (Rs 11,000-29,000), and luxury brands Salvatore Ferragamo and Versace(Rs 40,000-5 lakh).

The core traits of advanced technology and ruggedness are embodied by the flagship Timex (while some models are priced at Rs 695, most are above Rs 1,000, going up to Rs 14,000) and the youth -focused Helix (Rs 1,245-3,195) that Timex manufactures.

O'Brien explains, "There was a deviation as we were entering too many segments, but now we are getting back to our core strengths which are technology and outdoor sports. We want to keep the fashion brands, but the focus will be more on the core strengths." At present, 35 per cent sales come from the two core brands. Bandyopadhyay is keen on high value models as they instantly add to healthy margins.

Abneesh Roy, analyst at Edelweiss Research, says, "It is good that Timex is focusing on its core. In India, where watches have become more of a fashion statement, Timex should look at strong design that will be synonymous with the brand. So far, it has had a hard time because of its legacy in India of being a brand for the lower-end."

Timex also has to take distribution by its horns. O'Brien says the company has been shutting shops in non-metro cities which has not yielded results. "We have been on this correction drive for quite some time now. We have reduced about 18 per cent of our shops in non-metro cities. We had expanded in 2010 and 2011. The year 2012 was more of a consolidation year for us. We decided that we will reach the next level with the stores which are doing well and close those which did not take off. This will bring further stability to our business," says O'Brien.

Escalating real estate prices took a toll in the smaller cities, according to O'Brien. "It is not only us who have gone through this but the whole industry had to face this," she adds. Roy says, "The slowdown has hit all the players in the segment including Titan Industries, but the distribution of Titan is unparalleled in the industry. Timex will have to strengthen its distribution. While cutting down stores is good when needed, the problem arises when you stop adding stores."

Bandyopadhyay says the organised watch market is around Rs 5,000 crore. "We have about 8-9 per cent share, and are aiming for another 4-5 per cent in the next year," he adds. The company is looking to attain an annual growth of 12-15 per cent. Titan Industries leads with more than 50 per cent market share.

Trying to arrest scattered investment around the country, O'Brien adds that tier II and III cities which show potential for growth will be reached via its distribution channel, rather than its own stores. The company has 115 Time Factory stores, with plans for only 20 more this year.

Timex has moved from double-digit market shares to single digits now, weathering a split from JV partner, Titan Industries through 1998-2000, building its own distribution network, manufacturing units therafter, premiumising its product range, and even entering the luxury and fashion segments in branded watches. From posting profits a few year back, it ran into Rs 41.96 crore of losses in 2012-13.

But course corrections are coming through now. Timex will start with bringing in more high value models from its global portfolio that add to profitability, according to M K Bandyopadhyay, managing director, Timex Group India. Watches which will be reminiscent of the global branding, 'Timex - It Takes a Licking and Keeps on Ticking', by being sporty and macho.

More From This Section

The company has seen a senior management rejig this year and the new chairman, Gary Piscatelli, joined recently. Bandyopadhyay, too, is part of the new team at Timex.

In its initial days, Timex had focused on the lower end of the market, targetting the unorganised segment. After the split, it gradually began manufacturing and moving into the Rs 600-7,000 space and lately, even imported Rs 10,000-5 lakh fashion and luxury brands such as Nautica and Versace. In a hat-tip to the Indian market, it has two India-specific lines, Helix by Timex and a licensed line by Tarun Tahiliani. Helix launched in 2011 was meant for the youth, much like Titan's Fastrack.

The group will rationalise its portfolio in the mid-premium or fashion segment. For example, the head of retail and fashion brand, Angelique O'Brien, says, "A Rs 10,000 price-point watch cannot sell everywhere, so we are withdrawing our brand called Marc Ecko, by way of a corrective measure." Timex will continue with its other exclusive licensed brands such as fashion brands Nautica (Rs 8,500-21,500) and Tarun Tahiliani (Rs 11,000-29,000), and luxury brands Salvatore Ferragamo and Versace(Rs 40,000-5 lakh).

The core traits of advanced technology and ruggedness are embodied by the flagship Timex (while some models are priced at Rs 695, most are above Rs 1,000, going up to Rs 14,000) and the youth -focused Helix (Rs 1,245-3,195) that Timex manufactures.

O'Brien explains, "There was a deviation as we were entering too many segments, but now we are getting back to our core strengths which are technology and outdoor sports. We want to keep the fashion brands, but the focus will be more on the core strengths." At present, 35 per cent sales come from the two core brands. Bandyopadhyay is keen on high value models as they instantly add to healthy margins.

Abneesh Roy, analyst at Edelweiss Research, says, "It is good that Timex is focusing on its core. In India, where watches have become more of a fashion statement, Timex should look at strong design that will be synonymous with the brand. So far, it has had a hard time because of its legacy in India of being a brand for the lower-end."

Timex also has to take distribution by its horns. O'Brien says the company has been shutting shops in non-metro cities which has not yielded results. "We have been on this correction drive for quite some time now. We have reduced about 18 per cent of our shops in non-metro cities. We had expanded in 2010 and 2011. The year 2012 was more of a consolidation year for us. We decided that we will reach the next level with the stores which are doing well and close those which did not take off. This will bring further stability to our business," says O'Brien.

Escalating real estate prices took a toll in the smaller cities, according to O'Brien. "It is not only us who have gone through this but the whole industry had to face this," she adds. Roy says, "The slowdown has hit all the players in the segment including Titan Industries, but the distribution of Titan is unparalleled in the industry. Timex will have to strengthen its distribution. While cutting down stores is good when needed, the problem arises when you stop adding stores."

Bandyopadhyay says the organised watch market is around Rs 5,000 crore. "We have about 8-9 per cent share, and are aiming for another 4-5 per cent in the next year," he adds. The company is looking to attain an annual growth of 12-15 per cent. Titan Industries leads with more than 50 per cent market share.

Trying to arrest scattered investment around the country, O'Brien adds that tier II and III cities which show potential for growth will be reached via its distribution channel, rather than its own stores. The company has 115 Time Factory stores, with plans for only 20 more this year.

)