The stock of the departmental stores' chain hit a new high of Rs 3,888, up 3 per cent on the BSE in the intra-day trade today, commanding a m-cap of Rs 2.52 trillion. On Wednesday, Avenue Supermarts’ market-cap stood at Rs 2.45 trillion.

With this, Avenue Supermarts currently stands at 15th position in the overall m-cap ranking and is ahead of companies like Bajaj Finserv (m-cap of Rs 2.50 trillion), according to BSE. The company is just behind fast moving consumer goods (FMCG) and cigarette major, ITC, which has a m-cap of Rs 2.53 trillion.

Thus far in the month of August, Avenue Supermarts has outperformed the market by surging 11 per cent as compared to a 6.5 per cent rise in the S&P BSE Sensex. Further, in the past three months, the stock has rallied 25 per cent as against a 10 per cent gain in the benchmark index.

With continued upward movement, the stock price of Avenue Supermarts has zoomed 1,200 per cent from its issue price of Rs 299 per share. The company had made stock market debut on March 21, 2017.

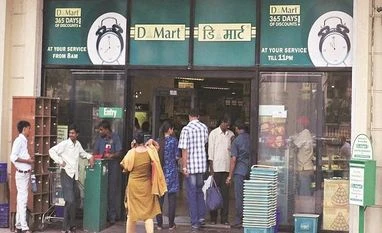

Avenue Supermarts is a Mumbai-based company, which owns and operates D-Mart stores. D-Mart is a national supermarket chain that offers customers a range of home and personal products under one roof. The company offers a wide range of products with a focus on Foods, Non-Foods (FMCG) and General Merchandise and Apparel product categories.

During financial year 2020-21 (FY2021), Avenue Supermarts saw de-growth across its key financial parameters of revenue, Ebitda (earnings before interest, taxes, depreciation, and amortization) and profit after tax due to Covid-led disruptions for a significant part of the year.

"However, despite a much stronger second wave of Covid-19 during the June quarter (Q1FY22), revenues grew 31 per cent over the corresponding quarter last year as lockdown periods were at different times in different regions during the quarter. The recovery in sales trend continues as authorities further ease restrictions in areas where Covid-19 infections have declined," the company said in investor presentation.

Since launching its first store in 2002 in Mumbai, Maharashtra, the company has grown to 234 stores with a retail business area of 8.82 million sq. ft.

Analysts at ICICI Securities anticipate store addition trajectory to accelerate in FY22 and FY23E and bake in 80 incremental store additions (addition of around 5.0 mn sq. ft). The robust liquidity position and healthy operating cash flows to provide impetus to store addition pace, the brokerage firm said.

Further, they expect revenue recovery to pick up pace from H2FY22 onwards and model revenue, earnings CAGR of 21 per cent, 25 per cent, respectively, in FY20-23E.

"Despite trading at premium valuations, Avenue Supermarts has been a consistent compounder with stock price appreciating at 31 per cent CAGR in the last three years. We continue to remain structurally positive and maintain HOLD rating," the brokerage firm had said in the result update.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)