A benign economic environment had already indicated that the March 2015 quarter numbers of India Inc would be weak. However, these came below Street expectations. What's worse is that the near-term outlook remains subdued forcing analysts to lower their earnings estimates for FY16 as well.

A look at the Bloomberg consensus data indicates the breadth of earnings downgrades and upgrades continues to be unfavorable with as much as 50 companies in the S&P BSE 100 index witnessing three per cent and above earnings per share (EPS) estimate cuts for FY16 between March 31 and June 10. On the other hand, only nine companies have seen a three per cent and above upgrade in their FY16 EPS estimates during this period. Fifteen companies within the private banks, consumers and chemicals sectors witnessed flattish FY16 EPS. Twenty-one companies witnessed a one-to-three per cent cut in their EPS estimates, while only four companies saw their estimates being raised in this range. In the case of GMR Infrastructure, analysts expect its loss per share or negative EPS to increase from Rs 2.2 earlier to Rs 2.4 as on June 10. Oil marketing companies (OMCs) led the way with strong EPS upgrades, while metal/power companies and public sector banks witnessed highest EPS downgrades. In auto, the trend was mixed. What's more, experts believe the pressure will remain for some more time to come.

“We believe consensus estimates of 23 per cent earnings growth in FY16 for MSCI India are vulnerable to downgrades. That said, we expect earnings growth of 10-12 per cent for FY16, driven by a modest economic recovery and lower input costs,” says Bharat Iyer of J P Morgan.

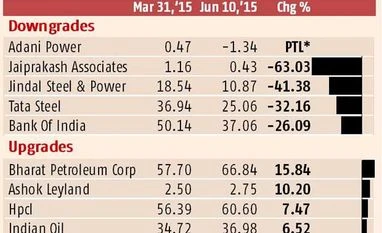

According to the data, Bharat Petroleum Corporation (BPCL) has witnessed the highest EPS upgrade of 15.8 per cent to Rs 66.84. It is followed by Ashok Leyland (up 10.2 per cent), Hindustan Petroleum Corporation (HPCL, up 7.5 per cent), Indian Oil Corporation (IOC, up 6.5 per cent) and IDBI Bank (up 4.6 per cent). The three OMCs have witnessed earnings upgrades on account of full de-regulation of diesel prices, pricing in of higher marketing margins going forward and given the reducing interest costs as well as benign crude oil prices. The Street continues to remain bullish on the OMCs as the subsidy overhang is largely behind and the financials will reflect business fundamentals more accurately and be predictable going forward.

Cyclical stocks in the metals and power sectors have witnessed sharp earnings downgrades after the March 2015 quarter. Adani Power, for instance, is now expected to post a negative EPS of Rs 1.34 for FY16 from positive Rs 0.47 expected earlier. Slow ramp-up in production from its captive mine, fuel security issues, weak rupee and fixed tariffs are likely to keep its financials muted in FY16, believe analysts. Other prominent companies that witnessed sharp downgrade in EPS estimate after the March quarter include Jaiprakash Associates (downgraded by 63 per cent), Jindal Steel and Power (downgraded by 41 per cent), Tata Steel (downgraded by 32 per cent) and Bank of India (downgraded by 26 per cent).

NMDC, Canara Bank, SAIL, Punjab National Bank and JSW Steel witnessed 17.6 to 22.4 per cent EPS downgrades following weak numbers. Weak volumes in domestic as well as international markets along with high impairments towards acquisitions impacted performance of metal companies in the quarter. On the other hand, asset quality stress has been a key concern for banking sector, especially public-sector banks. Worsening asset quality trends coupled with slowing credit off-take have hit public-sector banks and select non-banking financial companies.

“The Sensex earnings’ downgrade momentum remains high with our consensus FY16 EPS estimates pruned by four per cent. Autos, metals and IT accounted for 75 per cent of our earnings cut. Banks, autos are expected to account for bulk of the 17 per cent FY16 estimated earnings growth,” say analysts at Edelweiss Securities.

The worse is that while IT and pharma companies (the earnings drivers in the past) were expected to report benign earnings growth given the red flags raised by a few players in the early months of 2015, most companies in these so-called defensive sectors also witnessed earnings downgrades. The reason: revenue growth missed estimates on demand slowdown in global markets and adverse cross currency impacted margins of these companies.

“Our pharmaceutical universe posted muted sales growth led by slowdown in the US due to a lack of major Abbreviated New Drug Application approvals. Ebitda (earnings before interest, taxes, depreciation, and amortisation) growth for the universe was impacted by slowdown in the US, increase in R&D expenses and devaluation of currencies, particularly in Russia and Ukraine. Adjusted profit after tax growth for the universe was led by reduction in interest cost and tax rate,” says Hitesh Mahida, Pharma analyst at Antique Stock Broking.

A look at the Bloomberg consensus data indicates the breadth of earnings downgrades and upgrades continues to be unfavorable with as much as 50 companies in the S&P BSE 100 index witnessing three per cent and above earnings per share (EPS) estimate cuts for FY16 between March 31 and June 10. On the other hand, only nine companies have seen a three per cent and above upgrade in their FY16 EPS estimates during this period. Fifteen companies within the private banks, consumers and chemicals sectors witnessed flattish FY16 EPS. Twenty-one companies witnessed a one-to-three per cent cut in their EPS estimates, while only four companies saw their estimates being raised in this range. In the case of GMR Infrastructure, analysts expect its loss per share or negative EPS to increase from Rs 2.2 earlier to Rs 2.4 as on June 10. Oil marketing companies (OMCs) led the way with strong EPS upgrades, while metal/power companies and public sector banks witnessed highest EPS downgrades. In auto, the trend was mixed. What's more, experts believe the pressure will remain for some more time to come.

“We believe consensus estimates of 23 per cent earnings growth in FY16 for MSCI India are vulnerable to downgrades. That said, we expect earnings growth of 10-12 per cent for FY16, driven by a modest economic recovery and lower input costs,” says Bharat Iyer of J P Morgan.

According to the data, Bharat Petroleum Corporation (BPCL) has witnessed the highest EPS upgrade of 15.8 per cent to Rs 66.84. It is followed by Ashok Leyland (up 10.2 per cent), Hindustan Petroleum Corporation (HPCL, up 7.5 per cent), Indian Oil Corporation (IOC, up 6.5 per cent) and IDBI Bank (up 4.6 per cent). The three OMCs have witnessed earnings upgrades on account of full de-regulation of diesel prices, pricing in of higher marketing margins going forward and given the reducing interest costs as well as benign crude oil prices. The Street continues to remain bullish on the OMCs as the subsidy overhang is largely behind and the financials will reflect business fundamentals more accurately and be predictable going forward.

ALSO READ: Street sees 19% earnings growth in FY16

Cyclical stocks in the metals and power sectors have witnessed sharp earnings downgrades after the March 2015 quarter. Adani Power, for instance, is now expected to post a negative EPS of Rs 1.34 for FY16 from positive Rs 0.47 expected earlier. Slow ramp-up in production from its captive mine, fuel security issues, weak rupee and fixed tariffs are likely to keep its financials muted in FY16, believe analysts. Other prominent companies that witnessed sharp downgrade in EPS estimate after the March quarter include Jaiprakash Associates (downgraded by 63 per cent), Jindal Steel and Power (downgraded by 41 per cent), Tata Steel (downgraded by 32 per cent) and Bank of India (downgraded by 26 per cent).

NMDC, Canara Bank, SAIL, Punjab National Bank and JSW Steel witnessed 17.6 to 22.4 per cent EPS downgrades following weak numbers. Weak volumes in domestic as well as international markets along with high impairments towards acquisitions impacted performance of metal companies in the quarter. On the other hand, asset quality stress has been a key concern for banking sector, especially public-sector banks. Worsening asset quality trends coupled with slowing credit off-take have hit public-sector banks and select non-banking financial companies.

“The Sensex earnings’ downgrade momentum remains high with our consensus FY16 EPS estimates pruned by four per cent. Autos, metals and IT accounted for 75 per cent of our earnings cut. Banks, autos are expected to account for bulk of the 17 per cent FY16 estimated earnings growth,” say analysts at Edelweiss Securities.

The worse is that while IT and pharma companies (the earnings drivers in the past) were expected to report benign earnings growth given the red flags raised by a few players in the early months of 2015, most companies in these so-called defensive sectors also witnessed earnings downgrades. The reason: revenue growth missed estimates on demand slowdown in global markets and adverse cross currency impacted margins of these companies.

“Our pharmaceutical universe posted muted sales growth led by slowdown in the US due to a lack of major Abbreviated New Drug Application approvals. Ebitda (earnings before interest, taxes, depreciation, and amortisation) growth for the universe was impacted by slowdown in the US, increase in R&D expenses and devaluation of currencies, particularly in Russia and Ukraine. Adjusted profit after tax growth for the universe was led by reduction in interest cost and tax rate,” says Hitesh Mahida, Pharma analyst at Antique Stock Broking.

)