The MCX board has 10 members, with six independent directors (IDs) and three shareholder directors, from Canara Bank and the National Bank for Agriculture and Rural Development (Nabard), plus an Ajay Kumar. Together, the three directors hold around four per cent of the equity, of which three per cent is with Nabard.

FMC norms mandate that commodity exchanges have at least 50 per cent representation from independent directors, though there is no specific mandate on shareholder directors. However, the single largest shareholder can't be represented on the board, for technical reasons. Hence, the board is not properly represented.

Earlier this month, FMC also rejected the exchange’s choice of managing director (MD), saying proper procedures were not followed in the appointment. The issue will be on the agenda when the MCX board meets this month. Usually, a board-appointed committee decides on the the MD and chief executive officer but FMC has asked the exchange to also get the committee members approved by it.

The tough stance comes at a time when FMC is merging with the Securities and Exchange Board of India.

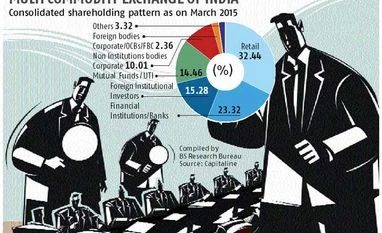

The exchange later found new shareholders after the exit of FTIL. It has seen its volumes and market share going up. However, with no MD for a year, MCX might find it tough to compete with the existing stock exchanges after the FMC-Sebi merger. Meanwhile, MCX has written to Sebi for permission to raise stake in the erstwhile MCX Stock Exchange (now Metropolitan Stock Exchange of India), from five per cent to 15 per cent.

)