After being quoted at a premium to its landed cost for several months, the price of gold was trading at a discount to a minor premium in recent weeks.

Imports increased in June but dwindled later as demand started drying in July, also a lean season month. Premiums for physical delivery in the spot market have been quoted around only $5 an ounce.

The market buzz is that the Reserve Bank of India is replacing its old stock of gold in its Nagpur vault with new, refined gold. The old stock could be coming to the Indian market and that supply hangover is keeping premiums under check.

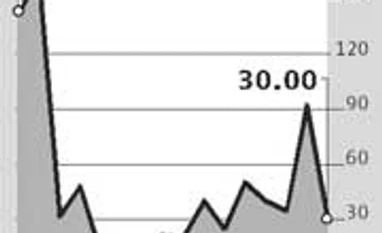

Gold prices were quoted with a high premium for physical delivery since the past one year, when imports were restricted under the ‘80:20’ rule. For a few months, premiums were $100-180 an oz over the landed cost of imported gold, when the market was adjusting to the new import rules. Later, it moderated.

However when there was no cut in import duty, the discount started evaporating and gold is now quoted at a premium, as stated earlier, of around $5 an oz.

Traders say demand generally remains dull in July. And, in the early part of the month, rain was elusive, raising fears that rural demand might not come up. Hence, “this month by now hardly 30 tonnes of gold might have been imported,” said a veteran in the bullion market.

As mentioned earlier, when RBI swaps gold in its own vaults for international-standard holdings, an estimated 48 tonnes could be put on the market. Assuming this happens, “that possible supply is also keeping premiums and imports under check”, said an expert who tracks gold closely.

While market has no clarity on how much gold is being swapped by RBI, the reports are that is likely to happen soon. However, “once this gold is exhausted and by that time the festive demand is also expected to return, premiums will be back and the range might be $20-30 an ounce,” said a non-bank gold importer.

Meanwhile, gold on Thursday closed Rs 28,150 per 10g at Mumbai’s Zaveri Bazaar.

Imports increased in June but dwindled later as demand started drying in July, also a lean season month. Premiums for physical delivery in the spot market have been quoted around only $5 an ounce.

The market buzz is that the Reserve Bank of India is replacing its old stock of gold in its Nagpur vault with new, refined gold. The old stock could be coming to the Indian market and that supply hangover is keeping premiums under check.

Gold prices were quoted with a high premium for physical delivery since the past one year, when imports were restricted under the ‘80:20’ rule. For a few months, premiums were $100-180 an oz over the landed cost of imported gold, when the market was adjusting to the new import rules. Later, it moderated.

However when there was no cut in import duty, the discount started evaporating and gold is now quoted at a premium, as stated earlier, of around $5 an oz.

Traders say demand generally remains dull in July. And, in the early part of the month, rain was elusive, raising fears that rural demand might not come up. Hence, “this month by now hardly 30 tonnes of gold might have been imported,” said a veteran in the bullion market.

As mentioned earlier, when RBI swaps gold in its own vaults for international-standard holdings, an estimated 48 tonnes could be put on the market. Assuming this happens, “that possible supply is also keeping premiums and imports under check”, said an expert who tracks gold closely.

While market has no clarity on how much gold is being swapped by RBI, the reports are that is likely to happen soon. However, “once this gold is exhausted and by that time the festive demand is also expected to return, premiums will be back and the range might be $20-30 an ounce,” said a non-bank gold importer.

Meanwhile, gold on Thursday closed Rs 28,150 per 10g at Mumbai’s Zaveri Bazaar.

)