With the relaxation in gold supply norms, jewellery exports from India are set to rebound in the coming months.

On Friday, the Directorate General of Foreign Trade (DGFT) agreed to all the suggestions of the Gems & Jewellery Export Promotion Council (GJEPC) for smooth supply of gold to exporters.

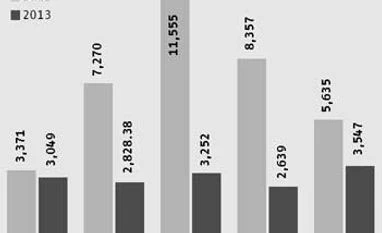

In the April-August 2013 period, gold jewellery exports from India fell 57.12 per cent to Rs 15,609.54 crore from Rs 36,404.17 crore in the corresponding period last year, primarily due to unavailability of gold for exporters. The unavailability had resulted from import restrictions by the government, aimed at containing the country's current account deficit.

Now, jewellery exporters would have easy access to gold, and this would help increase exports. Since the supply restrictions were implemented on July 22, a huge quantity of imported gold has been held at ports. Importers continued to pay demurrages; a number of export orders were cancelled, leading to huge losses for jewellers. This led to losses of at least Rs 25,000 for jewellery exporters for every Rs 1 crore of exports. The loss multiplied for diamond jewellery exporters, owing to higher costs of manufacturing.

"The gold export business will come on track now, with the fresh clarifications issued by DGFT. We will be able to receive gold smoothly, as all hazards have been cleared," said Pankaj Parekh, vice-chairman of GJEPC. A recent Reserve Bank of India (RBI) circular mandates the supply of 20 per cent imported gold to exporters. Jewellery exporters were afraid a higher quantity would be denied to them. And, banks were keen to supply only 20 per cent under the central bank's 20:80 formula. But now, jewellers would be able to secure higher quantities if they needed to, Parekh said.

Another major issue was documentary evidence proving inward remittance of foreign receivables of jewellery exports, showing the use of the first lot of gold procured from banks. This was required to secure a third lot of gold for jewellery exports, irrespective of the quantity. GJEPC argued exporters would have to wait for at least 280 days from the date the first lot was secured; this included 90 days of jewellery making, 180 days of inward remittance and 10 days of procedural delays. This would not only make business unviable; also, exporters would have to opt for new business. Now, DGFT has clarified a proof of exports would suffice and make jewellers eligible for a third lot.

Now, the ex-bond bill of entry wouldn't have to be filed every time, as mandated by the Customs earlier; a one time receipt would suffice, said Shah. With these clarifications, both gold and diamond jewellery exports were expected to pick up soon, Parekh said.

On Friday, the Directorate General of Foreign Trade (DGFT) agreed to all the suggestions of the Gems & Jewellery Export Promotion Council (GJEPC) for smooth supply of gold to exporters.

In the April-August 2013 period, gold jewellery exports from India fell 57.12 per cent to Rs 15,609.54 crore from Rs 36,404.17 crore in the corresponding period last year, primarily due to unavailability of gold for exporters. The unavailability had resulted from import restrictions by the government, aimed at containing the country's current account deficit.

Now, jewellery exporters would have easy access to gold, and this would help increase exports. Since the supply restrictions were implemented on July 22, a huge quantity of imported gold has been held at ports. Importers continued to pay demurrages; a number of export orders were cancelled, leading to huge losses for jewellers. This led to losses of at least Rs 25,000 for jewellery exporters for every Rs 1 crore of exports. The loss multiplied for diamond jewellery exporters, owing to higher costs of manufacturing.

"The gold export business will come on track now, with the fresh clarifications issued by DGFT. We will be able to receive gold smoothly, as all hazards have been cleared," said Pankaj Parekh, vice-chairman of GJEPC. A recent Reserve Bank of India (RBI) circular mandates the supply of 20 per cent imported gold to exporters. Jewellery exporters were afraid a higher quantity would be denied to them. And, banks were keen to supply only 20 per cent under the central bank's 20:80 formula. But now, jewellers would be able to secure higher quantities if they needed to, Parekh said.

Another major issue was documentary evidence proving inward remittance of foreign receivables of jewellery exports, showing the use of the first lot of gold procured from banks. This was required to secure a third lot of gold for jewellery exports, irrespective of the quantity. GJEPC argued exporters would have to wait for at least 280 days from the date the first lot was secured; this included 90 days of jewellery making, 180 days of inward remittance and 10 days of procedural delays. This would not only make business unviable; also, exporters would have to opt for new business. Now, DGFT has clarified a proof of exports would suffice and make jewellers eligible for a third lot.

Now, the ex-bond bill of entry wouldn't have to be filed every time, as mandated by the Customs earlier; a one time receipt would suffice, said Shah. With these clarifications, both gold and diamond jewellery exports were expected to pick up soon, Parekh said.

)