HDFC Bank managed to beat Street expectations once again. During the quarter ended September, it reported a net profit of Rs 1,982 crore ahead of Street's consensus estimates of Rs 1,964 crore. This would come as a positive surprise to investors prepared for worse, given several headwinds the bank faces: Low credit growth, tight liquidity, rising interest rate, falling GDP growth and pressure on assets. At 27 per year-on-year growth, earning growth was lowest in nearly a decade and below its historical trend growth of 30 per cent or more. The trajectory suggests earning growth could fall further if the macroeconomic environment remains challenging.

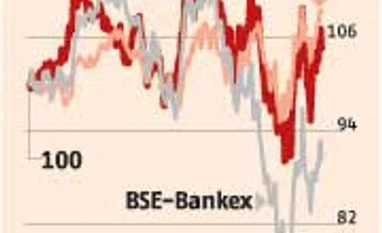

The stock market reacted negatively to the news. The stock closed the day down 2.4 per cent from the previous close, with most of the fall occurring after the results were announced. The market is concerned about the way the bank managed to beat street expectations on earnings. “Net profit was achieved through a control on operational expenses and lower provisions for bad assets rather than faster growth in core earnings such as interest or fee income,” says Dhananjay Sinha, co-head institutional equity at Emkay Global Financial Services.

The net interest income was lower than Street estimates. It reported a net interest income of Rs 4,476 crore, up by 20 per cent from a year ago, lower than the consensus estimates of Rs 4,570 crore. It limited its impact on earnings keeping a tight control on operational expenses, specially the employee cost. The salary bill grew 7.6 per cent year-on-year, its lowest pace in 15 quarters. This compares favourably with 16 per growth in its balance sheet (sum of loan and deposit growth) and 15 per cent growth in loan book. This lowered the expense ratio and aided margins. Analysts expect the trend to persist, given the organisational flexibility. At the peak of the global financial crisis in 2008-09, the bank had cut its employee expenses.The stock market reacted negatively to the news. The stock closed the day down 2.4 per cent from the previous close, with most of the fall occurring after the results were announced. The market is concerned about the way the bank managed to beat street expectations on earnings. “Net profit was achieved through a control on operational expenses and lower provisions for bad assets rather than faster growth in core earnings such as interest or fee income,” says Dhananjay Sinha, co-head institutional equity at Emkay Global Financial Services.

The provisioining coverage ratio (PCR) for bad assets declined 80 basis points on a sequential basis to 73.9 per cent. A year before, it was 81.9 per cent. According to estimates by Emkay Global, the net profit would have been lower Rs 43 core and earnings growth would have been 24 per cent (against 27 per cent) if the bank had maintained the ratio at last year’s level.

Part of this decline in PCR is explained by mark-to-market losses in its bond portfolio in the last quarter. The banks also took advantage of the new Reserve Bank of India regulations and transferred a part of its treasury portfolio to held to maturity (HTM) from available for sell. This will limit the MTM losses and aid earnings.

“HDFC bank earnings may decelerate a bit but it will still manage to outgrow the industry. The stock has corrected in anticipation and I don’t expect to foresee any further downside at current level,” says Devang Mehta, senior vice-president and head, equity sales, Anand Rathi Financial Services.

)