Though the stock markets have gone up, many offer good potential for returns. Quite a few still trade at a single-digit price to earnings (PE) ratio, despite expectations of high earnings growth over the next two years. Typically, a low PE stock indicates lower valuations. But, if the earnings growth is high compared to valuations, there is an opportunity. For, once the markets start to recognise the potential in these, valuation expansion takes place.

"If the fundamentals and earnings trajectory are changing for the better and are considered sustainable, there is scope for companies to get better valuations or PE," said Deven Choksey, managing director, KR Choksey Securities.

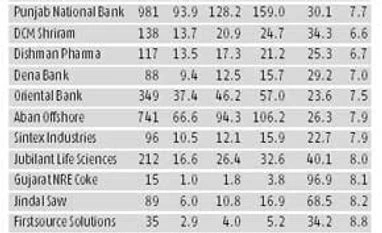

Business Standard looked at Bloomberg data of BSE 500 stocks to spot companies offering the highest earnings growth over the next two years and, simultaneously, trading at a single-digit PE. Among the top companies are Chennai Petroleum and JBF Industries. The two are expected to report 300 per cent annual growth in earnings during FY14-16 but still trade at less than five times their estimated earnings in FY15.

The Street expects their earnings growth to be driven by higher capital expenditure. JBF Industries, a leading entity in the polyester value chain, is increasing its capacities by setting up new projects in Belgium for PET chips and in Bahrain for BOPET film. The company is also setting up a PTA factory for backward integration. Put together, these are expected to help generate higher revenues, besides a 200 basis points improvement in operating profit margins to 10.2 per cent by FY16.

Relatively, the Street is more bullish on Gujarat State Fertilizers and Chemicals (GSFC) and Rain Industries. In the case of GSFC, there are nine 'buy' ratings as compared to one of 'hold'. Rain Industries has only 'buy' ratings (four), show Bloomberg data. GSFC is expected to benefit from lower working capital and a decline in interest costs, as well as the recent rise in product prices. Also, the company expects volumes to be higher because of the lower inventories in the market. Rain Industries, with presence in cement, power, chemicals and petroleum products, is expected to do well because of higher demand for calcined petroleum coke and cement. Additionally, it should also benefit from higher operating cash flows, leading to deleveraging of its balance sheet and, consequently, higher profits in the coming years. Analysts are also expecting the company's operating margins to improve, due to the pro-active steps taken earlier.

Among the fast growing companies are two turnaround candidates in the commodity space, Gujarat NRE Coke and Jindal Saw, into metcoke (used in steel making) and saw pipes, respectively. Both trade at eight times their estimated FY15 earnings. Jindal Saw could see its margins improving (400 basis points) because of the higher utilisation levels and growth in revenues, backed by a good order book. By FY16, its operating profit is expected to double. Though analysts remain cautious because of the high debt to equity of 1.7 times, the interest cover at over two times (based on FY14 financials) provides some comfort.

Similarly, investors can consider Aban Offshore, expected to benefit because of the higher demand for oil & gas exploration equipment such as rigs, stability in day rates and improved fleet utilisation. All these should help the company to minimise the impact of debt and interest cost, thus helping to grow faster. Others on the list seem as exciting. For instance, Firstsource, acquired by the Sanjiv Goenka group in 2012, reported a sharp bounce in profits in FY13. In 2013-14, net profit grew 32 per cent to Rs 193 crore, while sales grew 10 per cent to Rs 3,127 crore. The company, a business process outsourcing/management entity, offering services to the telecom, health care and banking, financial services & insurance sectors, among others, is expected report an over 30 per cent growth in earnings over the next two years.

Kolte Patil Developers, primarily a Pune-based realty player, has marginal debt (Rs 170 crore; debt-equity ratio of 0.22) and recently forayed into the Mumbai market. For FY14, though, sales grew only six per cent, while profits were down by five per cent.

In the plastic space, Sintex Industries is expected to report a revival in earnings. If earnings come as desired by the markets, expect stock gains to be stronger, led by PE re-rating. Analysts expect earnings revision, backed by higher growth and margins in domestic custom moulding, as well as good contribution to before-tax profit due to a new spinning project from FY16.

"If the fundamentals and earnings trajectory are changing for the better and are considered sustainable, there is scope for companies to get better valuations or PE," said Deven Choksey, managing director, KR Choksey Securities.

Business Standard looked at Bloomberg data of BSE 500 stocks to spot companies offering the highest earnings growth over the next two years and, simultaneously, trading at a single-digit PE. Among the top companies are Chennai Petroleum and JBF Industries. The two are expected to report 300 per cent annual growth in earnings during FY14-16 but still trade at less than five times their estimated earnings in FY15.

The Street expects their earnings growth to be driven by higher capital expenditure. JBF Industries, a leading entity in the polyester value chain, is increasing its capacities by setting up new projects in Belgium for PET chips and in Bahrain for BOPET film. The company is also setting up a PTA factory for backward integration. Put together, these are expected to help generate higher revenues, besides a 200 basis points improvement in operating profit margins to 10.2 per cent by FY16.

Relatively, the Street is more bullish on Gujarat State Fertilizers and Chemicals (GSFC) and Rain Industries. In the case of GSFC, there are nine 'buy' ratings as compared to one of 'hold'. Rain Industries has only 'buy' ratings (four), show Bloomberg data. GSFC is expected to benefit from lower working capital and a decline in interest costs, as well as the recent rise in product prices. Also, the company expects volumes to be higher because of the lower inventories in the market. Rain Industries, with presence in cement, power, chemicals and petroleum products, is expected to do well because of higher demand for calcined petroleum coke and cement. Additionally, it should also benefit from higher operating cash flows, leading to deleveraging of its balance sheet and, consequently, higher profits in the coming years. Analysts are also expecting the company's operating margins to improve, due to the pro-active steps taken earlier.

Among the fast growing companies are two turnaround candidates in the commodity space, Gujarat NRE Coke and Jindal Saw, into metcoke (used in steel making) and saw pipes, respectively. Both trade at eight times their estimated FY15 earnings. Jindal Saw could see its margins improving (400 basis points) because of the higher utilisation levels and growth in revenues, backed by a good order book. By FY16, its operating profit is expected to double. Though analysts remain cautious because of the high debt to equity of 1.7 times, the interest cover at over two times (based on FY14 financials) provides some comfort.

Similarly, investors can consider Aban Offshore, expected to benefit because of the higher demand for oil & gas exploration equipment such as rigs, stability in day rates and improved fleet utilisation. All these should help the company to minimise the impact of debt and interest cost, thus helping to grow faster. Others on the list seem as exciting. For instance, Firstsource, acquired by the Sanjiv Goenka group in 2012, reported a sharp bounce in profits in FY13. In 2013-14, net profit grew 32 per cent to Rs 193 crore, while sales grew 10 per cent to Rs 3,127 crore. The company, a business process outsourcing/management entity, offering services to the telecom, health care and banking, financial services & insurance sectors, among others, is expected report an over 30 per cent growth in earnings over the next two years.

Kolte Patil Developers, primarily a Pune-based realty player, has marginal debt (Rs 170 crore; debt-equity ratio of 0.22) and recently forayed into the Mumbai market. For FY14, though, sales grew only six per cent, while profits were down by five per cent.

In the plastic space, Sintex Industries is expected to report a revival in earnings. If earnings come as desired by the markets, expect stock gains to be stronger, led by PE re-rating. Analysts expect earnings revision, backed by higher growth and margins in domestic custom moulding, as well as good contribution to before-tax profit due to a new spinning project from FY16.

)