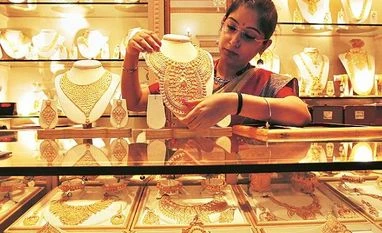

Consumers in India are selling old gold to benefit from high prices. The same is reflected in the data for the June quarter that the World Gold Council released on Thursday, in Gold Demand Trends.

The report stated consumers during the quarter sold 37.9 tonnes of old gold, which is the highest quarterly sale after September 2016, when old gold sale, or scrap supply, was 39 tonnes.

Gold jewellery sold and repurchased, or remaking gold, is not calculated as part of old gold sale.

In June, the gold price crossed $1,400 an ounce in global markets, which was a six-year high, and since then has remained above that. In addition, import duty has been raised by 2.5 percentage points, making gold even costlier.

On an annual basis, the supply of scrap gold in India is likely to be at a seven-year high and may rise to 100 tonnes, according to P R Somasundaram, managing director (India) of the World Gold Council.

In 2012, the supply of scrap gold stood at 118 tonnes because people encashed their jewellery owing to a surge in local prices.

After the Union Budget, the flow of smuggled gold to India increased and traders holding cheaper gold started selling. The spot gold market in Mumbai was quoting at a discount of $23-25 per ounce, “which is the highest after August 2016”, said the WGC’s Gold Demand Report.

The discount in spot prices over the cost of import comes to Rs 500 per 10 gm.

Somasundaram PR said, “We do not expect the hike in customs duty to have a long-term impact on gold in India, although it will have a dampening impact on demand in Q3. We continue to estimate India’s full-year gold demand to be in range of 750 to 850 tonnes in 2019.”

India’s gold demand in 2017 was 771 tonnes and in 2018 was 760 tonnes.

India’s gold demand went up by 13 per cent to 213.2 tonnes for April-June this year compared to 189.2 tonnes in the corresponding period last year.

“The increase in India’s gold demand during April-June can be attributed only to the price decline in April and May, when consumers found an opportunity to accumulate their metal holding,” said P R Somasundaram.

Robust trade promotion and a high number of auspicious days helped occasional gold buying.

However, the price rise in June and expectations of an import duty cut brought demand to a virtual standstill when the quarter ended.

Purchases by central banks globally and increased buying by financial investors who opt for gold-backed exchange-traded funds have supported demand, said the Gold Demand Trends.

Central banks bought 224.4 tonnes in April-June, taking their first-half buying to 374.1 tonnes, the largest net H1 increase in global gold reserves “in our data series. In a continuation of recent trends, buying was spread across a diverse range of — largely emerging market countries”, said the report.

Gold-backed exchange-traded funds’ holding grew 67.2 tonnes in the April-June period to a six-year high of 2,548 tonnes.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)