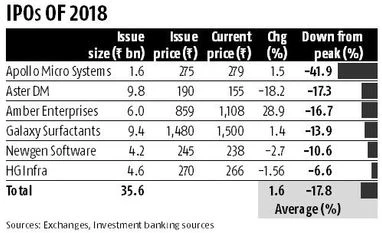

Shares of half a dozen companies that launched their initial public offerings (IPOs) in 2018 are up an average 1.6 per cent over their issue price. Further, shares of these companies have come down an average 18 per cent from their highs. The weak listing trend continued on Friday as shares of HG Infra Engineering, an infrastructure firm focused on road projects, slipped below its issue price on debut. Its shares fell as much as 7 per cent before closing 1.6 per cent lower on the National Stock Exchange.

According to experts, the lackluster performance of IPOs this year could impact participation of investors in the forthcoming share sales. At least six companies that are looking to raise a cumulative Rs 100 billion are expected to launch their IPOs in the coming weeks. Some of them include microfinance lending-focused Bandhan Bank, investment bank ICICI Securities, and restaurant chain Barbeque Nation. Two state-owned entities — Bharat Dynamics and Hindustan Aeronautics — will also launch their maiden offers next week.

“A lot of companies want to do their IPOs this month even though it is not the best of time. The markets have come off sharply from its peak. Also, the performance of new listings this year hasn’t been particularly great,” said an official with a domestic brokerage.

Part of the reason for the IPO rush this month is the new 10 per cent tax on long-term capital gains (LTCG), effective April 1. The LTCG tax outgo in many cases could be significant as the gains will be calculated on the cost of acquisition, which typically is miniscule for promoters, experts said.

“Coming out with an IPO is a long process. It involves a lot of regulatory filings and approvals. So it is not the case that anyone can do an IPO this month to save tax. However, any company that has all the approvals in place will want to do the IPO this month,” said an investment banker.

The benchmark Nifty is down close to 10 per cent from its all-time high touched in late-January. Also, the five companies that have listed this year, before HG Infra, are down an average 20 per cent from their highs. The weakness is expected to weigh on participation in IPOs. The subscription figures for most IPOs this year have been less-than-encouraging. Investment bankers are, however, confident that the IPOs that they get to the market will sail through.

“Irrespective of the market conditions, we are confident that all the IPOs will sail through. There is enough liquidity available. Large institutional investors are keen on participating in some of the offers that would be launched this month,” said the banker quoted above.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)