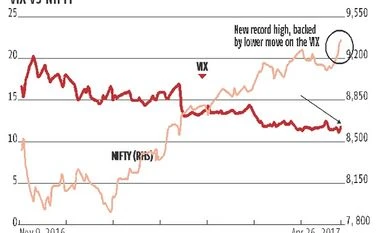

The market roared to new highs. This was due to a favourable initial result in French elections and hopes of deep tax cuts in US President Donald Trump's tax proposals. It may be noted that the French elections enter Phase-II and the extreme right-wing candidate still has a chance of winning. For that matter, Trumps' tax proposals have to pass Congress, and several stalwarts in his own party may oppose them.

The Nifty has climbed past 9,300 and tested resistance at 9,350. It would now have support in the 9,250-9,275 zone where the prior highs were established. The next strong support would be at 9,100-9,125. The breakout could set up a short-term target of 9,400-9,425.

The breakout to a new high above 9,273 is confirmation that the market remains very bullish. The intermediate trend has received a new shot in the arm. However, there was some profit-booking on Tuesday and there could be some profit-booking on the settlement.

Volumes were low, however, and advance-decline ratios also weakened on Wednesday. The FPIs (foreign portfolio investors) have bought on Monday and Tuesday but domestic institutions were more committed buyers. The dollar has fallen to Rs 64.12. Most trend-following systems would recommend staying long, with a stop at around 9,100. Traders could consider going long on dollar-rupee, purely on technical grounds.

The focus is on corporate results at one level but global news will also have an impact. Apart from Trump's taxes, tensions in Korea and French election news could feature in trading equations. The index started moving north in late December from 7,900 levels. It has now gained 18 per cent. Any intermediate correction could last four weeks or more, and a correction till 8,800 would be on the cards in a full-blown intermediate downtrend. The global attitude is still strongly pro-emerging markets. However, the IT sector and pharma stocks are seeing selling. Energy stocks, especially PSUs, have seen buying, following decent results by Reliance Industries.

The Nifty Bank is trending at about 22,250 now. A long May 25 23,000c (72), long May 25 21,500p (94) could be profitable in the next settlements — either side of this strangle would be hit if there are just two big trending sessions in May settlement. The cost of the position can be offset to some extent by selling a short May 04, 21,500p (23), short May 05, 23,000c (8). If either of the shorts is struck, the corresponding long position will gain in value. The VIX has dipped sharply, signalling a sanguine market. The May Nifty call chain has peak open interest (OI) at 9,500c, and high OI at every strike until 10,000c. The May put chain has very high OI at every strike down to 8,000p, with peaks at 9,200p, 9,000p, 8,800p and 8,500p.

The Nifty is at about 9,340. A long May 9,400c (88), short 9,500c (46) costs 42 and pays a maximum of 58. This is about 60 points from money. A long May 9,300p (88), short May 9,200p (58) costs 30 and it is just 40 points off the money. The close-to-money bearspread seems underpriced. One suggestion could be to take the CTM bearspread. A long May 9,200p (58), short 9,100p (39) costs only 19. This could pay 91 and it is 140 points off the money. This is also a possible position. A brave trader could take a short 9,500c (46) intending to reverse it within a couple of sessions since premiums usually post-settlement. Trend following systems suggest staying long in Nifty futures, with a trailing stop set at about 9,100 points. The long-term trend is bullish. Even in a correction, be wary of going short until and unless the index drops, combined to negative advance-declines ratio, and strong volumes in losing stocks.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)