After an overnight slump in US markets, the Nifty fell 1 per cent on Thursday, the expiry day for the month’s derivatives contracts. The index, which tracks the share price performance of 50 blue chip companies, ended the October derivative series with a loss of nearly 8 per cent.

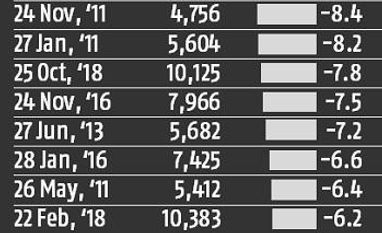

This was the worst performance for a derivative month since August 2013, when the index declined 8.4 per cent. Nifty is the most-traded futures and options (F&O) contract in the domestic markets.

Since the start of the September series, the Nifty has declined 14 per cent — its worst two-month rolling return in seven years. In the September series, the index had declined 6 per cent.

Last month’s fall was primarily on account of deterioration in macroeconomic conditions, while the latest correction was on account of the rout in global equities.

In the past, derivatives analysts say, the markets have seen a strong pullback after two straight months of sharp losses.

“Since 2011, whenever the Nifty has given two months of negative returns of more than 12 per cent back-to-back, the following month has been a bumper-return month. If history holds true and hopefully we are not in a 2008-like phase, November could be a stellar month,” says Yogesh Radke, Associate Director (institutional equities) at Edelweiss Securities.

Worst F&O series this decade

More From This Section

“For the Nifty, 10,000 remains an important level. If it manages to recover above 10,250, it can even head to 10,400-10,500. Many stocks are near the support zone and there is a strong possibility of a recovery,” says Sneha Seth, derivatives research analyst at Angel Broking.

“On the positive side, Bank Nifty has managed to hold its ground this month.”

The Bank Nifty index — the second-most traded derivative contract — fell less than 1 per cent during the October series. In the previous month, it had fallen 11 per cent —its worst monthly performance in 31 months.

Given the high weightage of banking stocks in the benchmark indices, experts say it is critical for them to rally if there has to be a meaningful pullback.

Meanwhile, rollover of Nifty contracts stood at 74 per cent, the highest in two years. In comparison, the Nifty rollover in the previous month was just 60 per cent. The market-wide rollover after the October series expiry was also high at 84 per cent.

Analysts said the high rollover doesn’t clearly indicate if the markets could fall further if there is a bounce.

“There are two ways to look at it. High rollover means investors are hedging their positions, which doesn’t necessarily mean the market will fall. However, it could also mean traders are holding on to their short positions, anticipating further downside,” said an analyst.

)