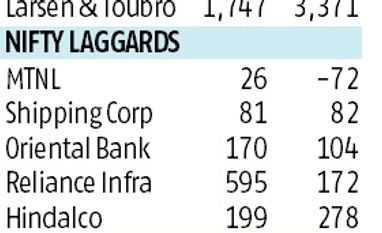

Among the laggards are Mahanagar Telephone Nigam (down 72 per cent), Shipping Corporation (up 81.5 per cent), Oriental Bank of Commerce (up 104 per cent), Reliance Infra (up 172 per cent) and Hindalco (up 278 per cent).

Interestingly, only half the companies, part of the index in 2003, continue to be part of Nifty. Some of the key present constituents not present earlier, are Tata Consultancy Services, Bharti Airtel, Kotak Mahindra Bank and Eicher Motors.

Interestingly, Eicher Motors, Kotak Mahindra Bank and Bharti Airtel were all listed in April 2003 but were not part of the Nifty index. These three in the past 1 4 years have gained 311 times, 128 times and 22 times, respectively.

Leaders and laggards based on Nifty components in 2003. Some stocks may not be part of the index now, *Change over Apr 28, 2003; (Source: NSE)

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)