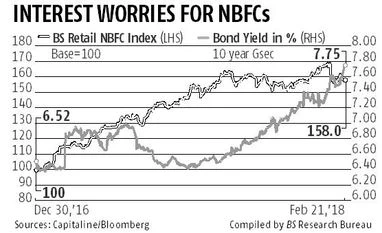

NBFCs' cost of funds was up 40 basis points (bps) during the first half of FY18 over the last fiscal year and analysts see its rising further as bond yields continue to head north. Yields on government of India 10-year bonds are up nearly 160 bps or 25 per cent in the past 15 months.

The hardest hit will be second- and third-tier NBFCs with lower credit rating and higher cost of funds. This, the analysts said, could lead to a re-rating of the sector on the bourses. The Business Standard (BS) retail NBFC index has doubled in value since January 2015 against 23 per cent rise in the benchmark S&P BSE Sensex during the period (see adjoining chart).

The interest cost for 22 retail NBFCs declined to 8.9 per cent (on average) during 2016-17 from a high of 10.4 per cent during 2012-13. It followed the trajectory of bond yields, albeit with a lag. The yields averaged 8.4 per cent during FY12 and it declined to as low as 6.2 per cent during the last quarter of the 2016 calendar year. Yields are currently hovering around 7.8 per cent.

"Retail NBFCs benefitted immensely from lower interest rate and benign liquidity conditions in the last three years. It not only lowered their cost of funds and boosted margins but easy availability of capital allowed them to raise their share of the overall loan market at the expense of commercial banks," said Dhananjay Sinha, head-research, Emkay Global Financial Services.

The combined loan book (or advances) by retail NBFCs in the Business Standard sample was up 19.3 per cent during the April-September 2017 period to reach Rs 9.6 trillion, growing at double the pace of growth (10.4 per cent) reported by commercial banks during the period. This came on the back of industry’s equally fast growth in the previous three years. Retail NBFCs’ loan book grew at a compound annual growth rate (CAGR) of 19.7 per cent during the three years ending March 2017. This was nearly thrice the pace of growth (6.9 per cent) in banks’ loan books during the period.

This translated into a profit boom in the industry and the combined net profit of NBFCs grew at a CAGR of 18.7 per cent during three-year period ending March 2017, making NBFCs one of the best-performing sectors on the bourses during the period. The BS NBFC index is up 35 per cent in the last 12 months against 17 per cent appreciation in the benchmark Sensex during the period.

Analysts now see a reversal as higher interest rates eat into industry margins, besides affecting the demand for retail credit. "Higher interest rates will affect NBFCs in two ways. First it will compress industry's NIMs or the spread of yield on assets over cost of funds. Secondly, higher interest rate could hit the demand for retail loans, lowering industry's pace of growth," said G Chokkalingam, founder & MD, Equinomics Research & Advisory.

Industry's NIMs improved to 730 bps during the first half of FY18 on average, from 540 bps during FY14. Historically there is a negative correlation between NIMs and bond yields. One basis point is one one-hundredth of a per cent.

Analysts also expect a rise in competition from commercial banks whose lending rates become more competitive in a high interest rate scenario. "As lending rates rise, banks become more cost competitive and they tend to grow faster than NBFCs. This will hurt NBFCs, especially the second-tier ones with lower credit rating and higher cost of funds," Sinha said.

Equity investors, it seems, have already begun to rebalance their portfolio. The NBFC index is down 6.2 per cent in the current month against the 5.7 per cent decline in the Sensex during the period.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)