The past two day’s gain has seen the market capitalisation (market-cap) of the company cross Rs 11 trillion on the bourses for the first time ever.

The investment by Saudi sovereign wealth fund is "at an equity value of Rs 4.91 trillion and an enterprise value of Rs 5.16 trillion", the company said in a statement in post-market hours on Thursday.

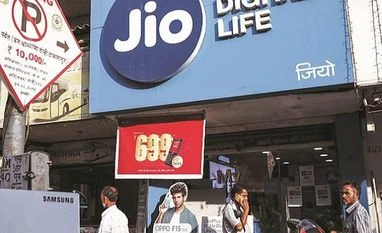

With this investment, Jio Platforms has raised Rs 115,693.95 crore from some of the leading global investment powerhouses at a time when the world is deeply impacted by the coronavirus pandemic, resulting in a recession kind of environment for the global economy.

RIL now net-debt free

In a separate exchange filing, RIL said that it has raised over Rs 168,818 crore in just 58 days through investments by global tech investors of Rs 115,693.95 crore and rights issue of Rs 53,124.20 crore.

Along with the stake sale to BP in the petro-retail JV, the total fund raise is in excess of Rs 1.75 lakh crore. With these investments, RIL has become net debt-free. The company’s net-debt was Rs 161,035 crore, as on 31st March 2020, it said.

Meanwhile, according to Bloomberg report, RIL is closing in on a deal that would see it acquire stakes in some units of Future Group, people familiar with the matter said, a move that would bolster the e-commerce ambitions of the conglomerate and its billionaire Chairman Mukesh Ambani. CLICK HERE TO READ FULL REPORT

Morgan Stanley maintains an ‘overweight’ on the stock with a target price of Rs 1,801, while Goldman Sachs has ‘buy’ call with a 12-month target price of Rs 1,755.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)