Surging global crude oil prices triggered a huge sell-off in domestic equities and bonds on Tuesday. Brent crude oil spot prices surged 3.5 per cent to $64.2 a barrel, the most since June 2015, amid a major political shake-up in Saudi Arabia, the world’s largest oil producer.

The benchmark Sensex fell 1.1 per cent, or 360 points, to close at 33,371, while the National Stock Exchange’s Nifty 50 declined 102 points, or 0.98 per cent, to 10,350. Both the indices fell the most in nearly six weeks. The yield on the benchmark 10-year government security hit a six-month high of 6.93 per cent. Meanwhile, the rupee ended at 65.03 against the dollar, compared to the previous day’s close of 64.68.

The domestic stock market fell even as most global markets traded positive.

“An exuberant Indian equity market needs to digest the far-reaching implications of the grave geopolitical developments unfolding in West Asia. Higher price of crude and its derivatives may dent profit margins of several companies,” said Ajay Bodke, chief executive officer, Prabhudas Lilladher.

In the past two weeks, Brent crude oil prices have risen by $7 a barrel. Experts see a higher probability of oil going to $70 a barrel than prices going down to $50. This could further spark a risk-off sentiment, wherein money will move out of equities into safer havens like gold and US dollar, say experts.

The Brent crude oil spot price was around $44 a barrel in late June, indicating that prices have gone up 45 per cent in less than five months.

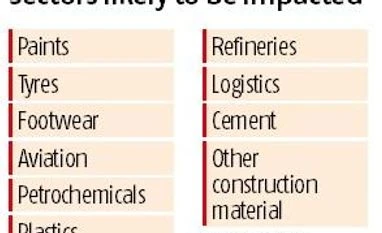

Market experts say high oil prices could impact the profit margins of companies across sectors such as refining, airline, paints, tyres, footwear, lubricants, cement, logistics, construction materials and chemicals for whom crude or its derivatives are major inputs/costs.

Nischal Maheshwari, Head of Institutional Equities at Edelweiss Securities, explains, “The first ones to get impacted would be the oil marketing companies (OMCs) and airlines, which have limited power to pass on the cost on account of higher crude oil prices. The second line of companies, who use the derivatives of crude as raw materials, such as those in sectors like paints, chemicals, plastics, etc. it will take a quarter or two for them to feel the impact of rising crude prices. We need to see how these companies will be able to pass on costs.”

Input costs are likely to follow rising oil prices, and, hence, the ability of companies to sustain profitability will depend on their capacity to take viable price hikes. Additionally, fuel and transportation costs are bound to increase across industries with rise in fuel prices.

Cement manufacturers are likely to feel the brunt of higher transportation costs. Power, fuel and oil costs account for roughly 20 per cent of total operating costs, or 15-16 per cent of net sales of cement companies. For aviation firms, power and fuel costs account for 25 per cent of total expenditure as well as revenues.

Other industries such as construction material and some other (non-oil) commodities too will feel the heat. Power sector, too, is vulnerable to rising oil prices, said Rakesh Tarway, head of research at Reliance Securities.

Similarly, oil marketing companies (OMCs) could see pressure on their margins, added Tarway.

Axis Securities Managing Director and Chief Executive Officer Arun Thukral felt that OMCs and aviation stocks could witness some profit-booking, while the upstream companies such as ONGC and Oil India would benefit due to rise in oil prices. However, with ONGC stock falling 2.4 per cent on Tuesday, some analysts believe that the market is worried that the government may ask the public sector oil-major to shoulder some burden of higher oil prices, as was the case in the past, despite the dismantling of administered pricing mechanism.

Industries such as petrochemicals, refineries, some consumer non-durable sectors such as paints, auto, as well as transportation and logistics players are expected to see pressure on the demand as well as on margins, says Bodke, adding that the impact is quite wide ranging for industries.

Reliance Industries, whose shares declined three per cent, dragged the Sensex down by 97 points. Most banking stocks saw declines. State Bank of India (SBI) fell 3.5 per cent on fears that the high oil prices would put pressure on recapitalisation proposal as it would hurt government finances.

Domestic investors sold shares worth Rs 2,050 crore on Tuesday, even as their foreign counterparts purchased shares worth Rs 462 crore. Worse, a rising import bill of the government could put downward pressure on the rupee. While a weak rupee would benefit export-oriented players, and the information technology industry, it will hurt ones that import a major part of their raw materials or components.

On the macro front, Thukral says a rise in crude oil prices beyond $60/barrel is going to hurt, leading to rising in current account deficit (CAD), which was reported at 0.7 per cent of GDP for FY17.

With imports of about 1,575 million barrels of crude oil on an annualised basis, a dollar increase in oil prices would increase the import bill by roughly $1.6 billion (Rs 10,000 crore) on an annual basis, said CARE Ratings. Bodke, too, sees import bill rising by $1.33 billion for every dollar a barrel rise in crude oil prices.

All these could weigh on inflation and rupee and hence, on interest rates. For many companies and sectors, this is not good news.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)