The Securities and Exchange Board of India (Sebi) has asked industry body, the Association of Mutual Funds in India (Amfi), to tone down its hugely successful ad campaign carrying the slogan ‘Mutual Funds Sahi Hai’.

The securities market regulator is concerned that the ads could persuade investors into buying mutual fund (MF) products without understanding the risks associated with them. Sebi has received complaints that the ad campaign is potentially being used for mis-selling MFs, particularly in smaller towns and villages.

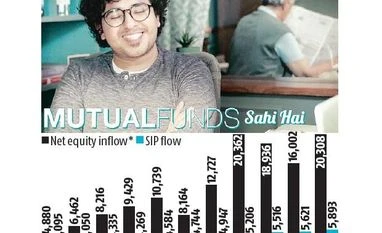

Sebi warning to the Rs 23-lakh crore asset management industry comes at a time when monthly inflows into equity schemes are regularly topping Rs 15,000 crore. Flows through systematic investment plans, or SIPs, too, are nearing Rs 6,000 crore a month.

Sebi has asked Amfi to moderate the ad campaign and highlight the practical aspect without claiming any life-changing experiences.

“We are working on the suggestion received from the market regulator. The idea of the campaign is to educate and increase awareness of the investment vehicle. At the same time, the message should highlight the risk factors, which would help investors make informed choices,” said A Balasubramanian, chairman, Amfi, who is also the chief executive officer (CEO), Aditya Birla Sun Life Mutual Fund.

Launched early this year, the Amfi campaign talked about the value that MFs bring forth along with the assurance of solid return in the long term. The advert targets those who are yet to experience MF investing or the gamut of schemes on offer.

Other than the usual disclaimer, experts say the ads do not properly spell out the risks associated with the underlying assets, which include equity, debt, and gold. It should in some way capture how the underlying assets can be volatile in the near term, they say.

“MFs are a great vehicle for small investors. The ad campaign has played a big role in attracting millions of new investors. The stories under the aggressive campaign, with the punchline ‘Sahi Hai’, woven around a dream fulfilled can induce a false sense of comfort. There is no mention of the downside. Suitability may be sidelined when products are being sold. There is a need to ensure no mis-selling is being done,” said Prithvi Haldea, founder and chairman, Prime Database.

Others feel the campaign has opened up MFs as an important investment vehicle. “It is a mass media campaign helping in creating awareness about MFs. It piques curiosity about the segment without pushing people to reconsider their investment strategy. It is just driving them to the next level of buying MFs,” said Dhirendra Kumar, founder and CEO, Value Research, an MF research company. He adds that MFs are well regulated and have stringent laws in place on transparency and disclosures.

To tackle various issues of the MF industry, Sebi has constituted an expert team to look into corporate governance issues and the risks involved with MF products. The regulator is also monitoring the inflows, which have been on the rise this year.

“We are cautious about the inflows and are trying to be actively involved to see whether mis-selling is driving the inflow. Subsequently, we are taking a lot of measures on various fronts, which will be soon put out publicly,” said Sebi Chairman Ajay Tyagi at an industry event last week. He said MF is a good story and Sebi wants it to sustain.

Net inflows into equity schemes this year stood at Rs 1.36 lakh crore at the end of November, and have played an important role in the benchmark indices climbing more than 25 per cent.

Sebi recently issued new norms on rationalisation and categorisation of MF schemes, a move aimed at increasing transparency. The market regulator is also soon expected to propose norms to reduce the cost of investing in MFs.

Further, the regulator is also miffed with the high commissions MFs paid distributors in the last six months to sell new fund offers. However, sources in the Amfi say that a significant number of asset managers moved to a commission structure after the regulator raised concerns over upfront fees paid to distributors.

*Includes Equity Linked Savings Scheme; Systematic Investment Plan flows across different asset classes and not just equity. Source: Amfi

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)