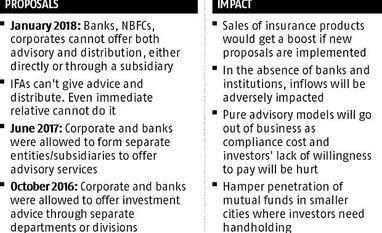

The industry, which has been riding high due to robust inflows of Rs 50 billion a month from the systematic investment plan route could suddenly find itself in a situation when one of the prime contributors to the assets under management, banks, will be completely out of action. “If the proposals are implemented, around 40 per cent of inflows will be impacted as wealth management arms of banks will no longer be able to give advice on mutual funds,” said the CEO of a fund house.

“The latest proposals will also drive the bulk of the business towards the distribution side,” said Dhirendra Kumar, CEO, Value Research. Distribution per se is a straightforward business model wherein the distributor receives a certain commission, either trail or upfront.

The business model of independent financial advisors (IFAs) will also be adversely impacted and most could simply go out of business. Sandeep Parekh, founder of Finsec Law Advisors, said the market regulator’s move would actually the harm retail investors. “If these guidelines are implemented in this manner, the business of investment advice will no longer be lucrative. So only the richest will be able to secure investment advice, as it has happened in the UK where such a guideline exists. Retail investors will not receive any advice, which is harmful for them.” At present, there are about 100,000 mutual fund distributors with about 10,000 ones active, on industry estimates.

This means that wealth management arms of banks, one of the big sources for mutual flow inflows, will not be able to offer mutual fund advice. Currently, the MF sector’s inflows come from three sources – 40 per cent from banks and 30 per cent each from independent financial advisers and national distributors. Industry players said for leading players like ICICI Prudential Mutual Fund, HDFC Mutual Fund and others, collection from their bank branches would be higher.

The latest proposals also bar registered investment advisers from distributing mutual funds through immediate relatives. “The interpretation makes it amply clear that one entity or family cannot offer both distribution and advisory services,” said Anjaneya Gautam, national head – mutual funds, Bajaj Capital, a national distributor that is also separately registered as an investment adviser. Fund heads point out that there could be a case where one brother was an investment adviser and another a distributor. “How can a person just shut down the business because his brother is an investment advisor or vice versa?” said a fund manager.

Sundeep Sikka, CEO, Reliance Nippon Life Asset Management Company, believes allowing IFAs to advise and distribute, but only for certain kind of investors, will make things better. For example, allowing an IFA to offer advice to the retail investor, but to act only as a distributor for large investors. “There can be different rules for both categories. But this could help,” said Sikka.

The proposed changes will hamper mutual fund penetration in smaller cities as these investors need hand holding. One out of every rupees five invested by individual investors in mutual fund schemes now comes from B15 cities.

As of November 2017, 18 per cent of MF assets came from B15 locations. Assets from B15 locations have risen to Rs 4.1 trillion in November 2017 from Rs 2.81 trillion a year ago, data from the Association of Mutual Funds in India showed.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)