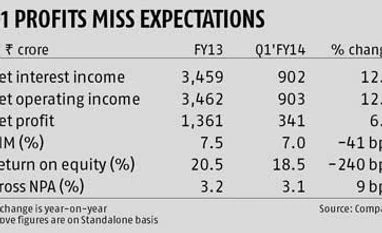

Leading commercial vehicles (CV) financier Shriram Transport Finance Company (STFC) may have reported a lower-than-expected net profit for the quarter ended 30 June 2013, but the markets seem impressed with the company. The stock rose by 2.35 per cent to Rs 678 at the end of day on Tuesday, compared to a 0.7 per cent rise in the Sensex. While margins dipped and higher provisions impacted bottom-line growth for the quarter, the surprise came from the company's ability to keep asset quality in control.

The stock has under-performed the Sensex since start of June, driven by rising concerns on its asset quality due to the weak macro environment. Analysts believe the current stock valuations of 1.8 times FY14 estimated book value adequately captures the negatives of slower disbursements growth and rising asset quality pressures.

According to Santanu Chakrabarti, financials analyst at ICICI Securities, STFC's strong asset under management (AUM) growth was driven by traction in the old CV book (82 per cent of total portfolio). "Gross NPA (non-performing asset) numbers have gone up sharply on a sequential basis though they appear to be adequately provided for. STFC has managed well in worst cycles earlier and we believe it is a good stock to hold in down-cycles like these." He has a 'buy' rating on the stock with a target price of Rs 880.

According to Bloomberg data, of 10 analysts who covered STFC in July 2013 so far, five have 'buy' recommendation and two have 'sell' recommendation on the scrip, with an average one-year target price of Rs 789 indicating an upside potential of 16 per cent.

Margins pressure, strong loan growth in Q1

STFC saw its net interest margin (NIM) fall by 41 basis points to 7.01 per cent in the June 2013 quarter, compared to the year-ago period. Even on a sequential basis, NIM was down by 22 basis points. Higher cost of funds impacted margins. Secondly, STFC, which largely funds the purchase of second-hand CVs that yield higher margins, also saw the proportion of newer vehicles rise in its portfolio.

Asset quality pressure

For the June quarter, while provisions increased 23 per cent over last year to Rs 239 crore, the gross NPA ratio remained largely stable at 3.09 per cent (versus 3.0 per cent last June). Notably, even as net NPA levels were up 6 basis points to 0.68 per cent, on a sequential basis, the company has seen this decline by 9 basis points. This has surprised many analysts as truck operators are facing pressure on their incomes on account of rising fuel and other costs.

Hence, going ahead, analysts believe the company's asset quality could see some pressure due to weak macroeconomic growth.

The management, though, is hoping a good monsoon will provide some relief. Parag Sharma, chief financial officer of Shriram Transport Finance, says: "Our customers' livelihood depends on their CV business and they keep shifting buckets in weaker times such as these. However, given the good monsoon, we believe post-September agricultural freight movement will pick up and hence improve repayments from our customers."

Sharma expects the company's gross NPAs to be between 3 and 3.2 per cent in FY14 and he does not expect any significant rise in provision coverage ratio from 78-80 per cent levels. Nevertheless, the Street would closely track the trend in asset quality over the next few quarters.

In terms of business growth, STFC's management expects the second half of this financial year to be better with likely pick-up in freight rates. It expects the AUM to grow by 21 per cent in FY14 to Rs 60,000 crore and net profit growth to be around 12-15 per cent.

The stock has under-performed the Sensex since start of June, driven by rising concerns on its asset quality due to the weak macro environment. Analysts believe the current stock valuations of 1.8 times FY14 estimated book value adequately captures the negatives of slower disbursements growth and rising asset quality pressures.

According to Santanu Chakrabarti, financials analyst at ICICI Securities, STFC's strong asset under management (AUM) growth was driven by traction in the old CV book (82 per cent of total portfolio). "Gross NPA (non-performing asset) numbers have gone up sharply on a sequential basis though they appear to be adequately provided for. STFC has managed well in worst cycles earlier and we believe it is a good stock to hold in down-cycles like these." He has a 'buy' rating on the stock with a target price of Rs 880.

According to Bloomberg data, of 10 analysts who covered STFC in July 2013 so far, five have 'buy' recommendation and two have 'sell' recommendation on the scrip, with an average one-year target price of Rs 789 indicating an upside potential of 16 per cent.

Margins pressure, strong loan growth in Q1

STFC saw its net interest margin (NIM) fall by 41 basis points to 7.01 per cent in the June 2013 quarter, compared to the year-ago period. Even on a sequential basis, NIM was down by 22 basis points. Higher cost of funds impacted margins. Secondly, STFC, which largely funds the purchase of second-hand CVs that yield higher margins, also saw the proportion of newer vehicles rise in its portfolio.

Asset quality pressure

For the June quarter, while provisions increased 23 per cent over last year to Rs 239 crore, the gross NPA ratio remained largely stable at 3.09 per cent (versus 3.0 per cent last June). Notably, even as net NPA levels were up 6 basis points to 0.68 per cent, on a sequential basis, the company has seen this decline by 9 basis points. This has surprised many analysts as truck operators are facing pressure on their incomes on account of rising fuel and other costs.

Hence, going ahead, analysts believe the company's asset quality could see some pressure due to weak macroeconomic growth.

The management, though, is hoping a good monsoon will provide some relief. Parag Sharma, chief financial officer of Shriram Transport Finance, says: "Our customers' livelihood depends on their CV business and they keep shifting buckets in weaker times such as these. However, given the good monsoon, we believe post-September agricultural freight movement will pick up and hence improve repayments from our customers."

Sharma expects the company's gross NPAs to be between 3 and 3.2 per cent in FY14 and he does not expect any significant rise in provision coverage ratio from 78-80 per cent levels. Nevertheless, the Street would closely track the trend in asset quality over the next few quarters.

In terms of business growth, STFC's management expects the second half of this financial year to be better with likely pick-up in freight rates. It expects the AUM to grow by 21 per cent in FY14 to Rs 60,000 crore and net profit growth to be around 12-15 per cent.

)