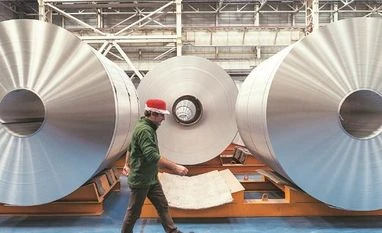

India's steel exports are expected to remain strong, on the back of higher global prices, amid falling Chinese shipment as Beijing focuses on cutting around 30 million tonnes of excess annual capacity, to curb air pollution.

Exports during the first 10 months of this financial year jumped 40.2 per cent from same period last year, while domestic consumption grew 5.4 per cent. Production in the period was about 88.6 million tonnes.

“It is the increase in export which is helping domestic production go up. We expect the year (FY18) to end with production of more than 100 mt, mainly to cater to the export market,"said an an analyst with a local brokerage, on condition of anonymity.

Currently, Indian prices are around $650 a tonne; in the US, close to $900 a tonne. Europe's steel is about $750 a tonne and so is South Korea's and some other Asian countries, said industry officials.

Industry officials think encouraging economic indicators in India could also push domestic demand. The country's industrial production growth in January was 7.5 per cent, from 7.1 per cent the previous month. Manufacturing, in general, grew 8.7 per cent. January was also the third successive month of more than seven percent industrial growth. The capital goods segment grew 14.6 per cent, compared with a 0.6 per cent contraction in the year-ago period.

“We will be refocusing on the domestic market, as we are seeing a growth cycle pick-up. We are likely to re-orient our product mix to domestic, bringing down the export ratio in the total revenue basket,” said Jayant Acharya, director (commercial) at JSW Steel. “Some part of this will play out in this quarter and the export ratio should gradually come below 20 per cent.”

Export at the Sajjan Jindal-led JSW is now 23-25 per cent of total revenue. “The automobile (sector's) requirement has moved up in the domestic market, which will call us to redirect hot and cold rolled, along with galvanised steel, to the domestic market from export,” informed Acharya.

Though domestic demand for steel is seen picking up, views remained mixed on whether capital expenditure growth cycle will pick up. The government has set an ambitious target of 300 mt in annual production by 2030.

“Today, we are 90-95 mt (annual) consumption and if we take seven-eight per cent (yearly) Gross Domestic Product growth, consumption should go to 120-130 mt. We do not have the capacity to meet this demand. The worry is that this scenario should not lead us to become a net importer of steel in the next five years,” said H Shivram Krishnan, director-commercial, Essar Steel.

Currently, Tata Steel and JSW Steel are the only two producers to have announced expansion projects, of five mt each, at Odisha (Jajpur) and Maharashtra (Raigad), respectively.

“We do not expect new project announcements in the near term, as the investment scenario is still not strong, due to debt-laden balance sheets,” said Jayanta Roy, senior vice-president at ratings agency ICRA. “However, the NCLT assets (those under going bankruptcy sales), once with stronger managements, could be utilised better to meet demand. But, it would mean (only) the existing capacity is being utilised," he explained.

At present, the domestic steel industry's average capacity utilisation is 82 per cent.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)