Top Section

Explore Business Standard

Top Section

Explore Business Standard

Don’t miss the latest developments in business and finance.

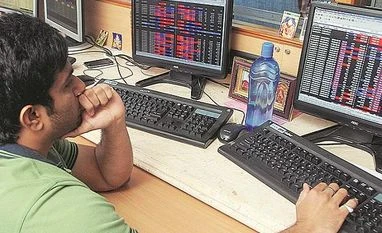

CLOSING BELL: The key benchmark indices gyrated in a narrow trading band on Monday, before settling with losses as FMCG stocks slipped.

)

First Published: Nov 14 2022 | 8:15 AM IST