Maruti Suzuki India Ltd, the maker of half the cars sold in India, slid to a one-month low. Housing Development Finance Corp and Adani Ports & Special Economic Zone Ltd were among the worst performers on the S&P BSE Sensex. Tata Power Co and Adani Power Ltd tumbled after the companies were denied an increase in rate by a tribunal.

The Sensex slid 0.9 per cent to its lowest level since March 17. The gauge in March capped its best month since January 2012, as global funds bought $4.1 billion of shares, the most in three years. Company results will be closely watched by investors for signs that earnings are reviving after falling in four of the past five quarters. Net incomes are likely to grow 3.3 per cent in the quarter ended March, data compiled by Bloomberg show.

"Valuations are still high if you consider that the March-quarter is likely to see single-digit earnings growth," A K Prabhakar, head of research at IDBI Capital Market Services Ltd, said by phone from Mumbai. "Last month's rally was a pullback rally, which is typical of a bear market. We are advising investors to raise cash."

Fifty-three per cent of the 30 Sensex companies that reported earnings for the December quarter have beaten estimates. That compares with 57 per cent in the quarter ended September 30 and 60 per cent in June, data compiled by Bloomberg show. The gauge trades at 15 times 12-month projected profits versus 11.5 for the MSCI Emerging Markets Index.

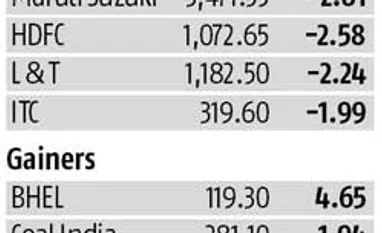

Maruti Suzuki declined three per cent to its lowest level since March 8. Housing Development Finance retreating three per cent, sliding for the ninth out of 10 days. Adani Ports plunged 3.4 per cent, the worst performer on the Sensex.

Tata Power tumbled the most since February 11, the worst performance on the NSE Nifty 50 Index. Adani Power declined three per cent to its lowest level since March 30.

Indian equities bucked gains in other Asian markets. The MSCI Asia Pacific Index climbed one per cent after oil jumped and Federal Reserve (Fed) meeting minutes showed policy makers won't rush to raise interest rates. Traders are assigning zero per cent chance of the Fed increasing rates in April.

"The Fed's minutes show that world's biggest economy is still not confident in its outlook on the global economic growth," Arun Kejriwal, a director at Kejriwal Research & Investment Pvt in Mumbai, said by phone. The dovish stance "is a temporary relief to the market in the short term but shows the longer-term concerns on growth remain."

The NSE (National Stock Exchange) Nifty 50 Index dropped one per cent to 7,546, breaching its 100-day moving average. The gauge is trading eight per cent above its 200-week mean of 6,972.6.

A breach of this level could worsen the decline, IDBI's Prabhakar said.

"The market has historically honored 200-week moving averages, and if it were to fall below 6,900 the next time, the correction can be of a higher degree, he said.

)