Infosys, which has gained nearly six per cent, was the biggest gainer on both the indices and contributed to 80 per cent of the gains. The country’s second-largest software exporter gained the most in nearly nine months after it forecast its 2016-17 sales to grow between 11.8 and 13.8 per cent in dollar terms, more than what analysts had projected. The shares of bigger rival, Tata Consultancy Services (TCS), fell as much as three per cent after a US court slapped a penalty of nearly $1 billion. The stock, however, recovered most of its losses on positive expectations from its results, which were announced after market hours. The TCS stock ended at Rs 2,522 a share on the BSE on Monday. A US federal jury has asked TCS to pay $940 million for using data from Epic Systems without permission. The company plans to appeal against the judgment.

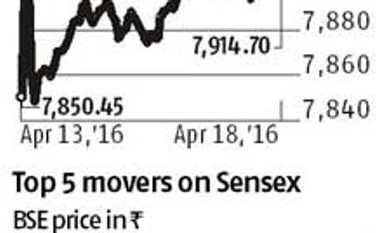

The Indian market, which resumed trading on Monday after public holidays on Thursday and Friday, has gained five per cent in the past four sessions. The benchmark indices have extended the gains, which began on March 1, to 12 per cent.

Following the sharp run, the Nifty has recovered almost all its 2016 losses and is currently down only 0.4 per cent for the year. The Sensex, on the other hand, is only 1.15 per cent shy from logging a new 2016 high.

Analysts say the market ending above the 200-DMA, a long-term moving average, is a positive sign but if the market is able to surpass the 2016 highs, it could lead to further gains.

“A major resistance for the Nifty is the 2016 high of 7,972 touched in January. Once the market turns positive on a year-to-date basis, we could see further momentum,” said Hemant Nahata, head of derivatives at India Infoline. “If the Nifty tops 8,000, we can see it going up to 8,200 or 8,300.”

“The momentum looks strong. There is a possibility of another 100 points rally on the Nifty. However, if the market slips below Monday’s close, it could be a bearish pattern leading to some correction,” said Sacchidanand Uttekar, analyst at Motilal Oswal.

On Monday, FIIs invested nearly Rs 1,000 crore into Indian stocks, provisional data showed.

)