Sentiments, which were earlier subdued due to the soft sowing start in the Rabi season and continued weak global agrochemical demand, have started turning in favour of crop-care companies.

In the domestic market, analysts expect improved crop prices and anticipated government thrust in the election year to drive farmers’ income.

Analysts at the IIFL say that prices for crops such as corn were up by 49 per cent year-on-year (YoY), while those of wheat, cotton, and mung were up in the 13-18 per cent range. This should bode well for acreages of these crops during the upcoming Kharif season.

Crop prices have already improved across the board, with rising minimum support prices and further benefits of farm loan waiver, money transfer under the PM-Kisan Yojana as key triggers. Direct subsidy transfer implementation will lead to lower working capital requirement (for urea players), improving overall profitability.

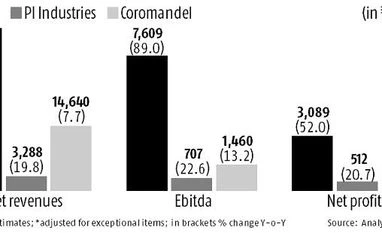

For instance, PI Industries reported revenue growth of 32 per cent YoY, led by robust export growth of 40 per cent. Exports account for three-fourth of sales. Domestic business saw just 9 per cent growth, though this was better than the industry growth.

Analysts believe that as custom synthesis and manufacturing (CSM) gathers stream, PI is looking at growth over the long term. CSM business, driven by improved demand in key markets, has led the company management to reiterate revenue growth guidance of 20 per cent for 2018-19.

UPL, too, had seen revenues grow 17 per cent, largely led by Europe (up 36.6 per cent YoY), Latam (up 26.5 per cent), North America (up 21.5 per cent), and the rest of the world sales (up 12.7 per cent), while India sales declined 20.8 per cent YoY due to poor kharif yields.

Analysts at Edelweiss say there are signs of pick-up in the global agrochemical cycle along with positive commentaries from major contract research and manufacturing services players (PI and SRF) and believe this segment is set to post robust growth after nearly two tepid years. Their top picks include PI Industries, Coromandel International, and Jain Irrigation.

Amongst domestic peers, the second-largest phosphatic fertiliser player and complete crop-solution provider Coromandel International is well placed to benefit from the demand uptick. Improved reservoir levels in South India are a positive and should benefit the company.

Having seen revenues grow 22.1 per cent during first nine months, input cost pressures should ease with recent price hikes. Further margins too should be protected, given its global alliances will minimise volatility on raw material availability as well as prices. Capacity enhancement from 19.25 lakh million tonnes per annum (mtpa) to 22 lakh mtpa at its Kakinada plant, too, will act as a trigger.

The biggest upgrades are coming in for UPL, given the diversified presence across geographies, low-cost manufacturing base in India, and recent acquisition of Arysta. Analysts at Jefferies expect sales/earnings growth at compound rate of 21-33 per cent FY18-21, factoring in the financials of Arysta in 2019-20 and 2020-21.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)